Mortgage Rates remain flat to slightly better than last Friday. Mortgage Bonds and Treasury Bonds defy logic after the Fed Tightening news. There are only so many ways this “head scratcher” makes any common sense, but here are 3 of my hypothesis:

- The news of Fed Tightening was already baked into the market, and we now have a relief rally.

- Markets are concerned about the COVID variants spreading and slowing economic activity (capital moves to bonds as a safe haven when fear emerges).

- Stock Market Selling and Volatility are adding weight to the fear gage.

Bottom Line: A mortgage bond price has broken the range of a negative trend. This also puts the MBS back above the 21 day moving average and right on target to cross above the 50 DMA. If this happens, count on a much bigger rally = lower rates. Today I am advising clients to float carefully!

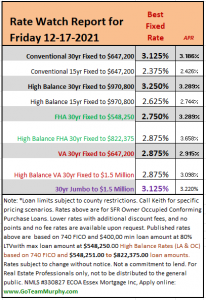

*NOTE: FHA loan limits do not increase until 1-1-2022, hence the lower 2021 loan limits for FHA “only” below.