The Sky: NOT Falling

Many are jumping to extreme conclusions about the impact of higher rates, high inflation, and a potential recession on the housing market.

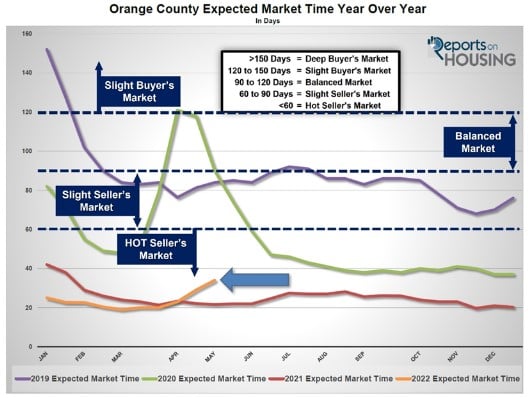

While the market is slowing, it is gradually evolving from its out of control, insane pace, to a normal Seller’s Market where pricing will be fundamental in finding success.

In flipping open a Merriam-Webster Dictionary and looking up “Chicken Little,” it states, “one who warns or predicts calamity especially without justification.” Economists are used to the constant chatter about recessions, bubbles, and plunging home prices. The current economic environment has amplified the noise: surging interest rates, highest inflation since 1981, and a volatile stock market. This will definitely have an impact on the economy and housing, yet it will not be to the extent of the fearmongering masses who immediately jump to the worst possible outcome. The sky is NOT falling when it comes to housing.

Most people remember the burn of the Great Recession. It either happened to them specifically, a family member, or a friend. There was an unstoppable wave of foreclosures and short sales. Home prices plummeted, erasing years of incredible gains. Unemployment jumped and took over six years to recover. The Great Recession was the largest economic downturn since the Great Depression, and it has left deep scars on society at large. Flash forward to today and home prices continue to soar, interest rates remain elevated above 5%, housing is just starting to slow, and many are calling for an imminent recession.

Only two of the last six recessions negatively impacted housing values here in Southern California, and both were caused by the housing industry. The savings and loan crisis of the 1980’s and early 1990’s led to a recession and an erosion in homes values that started in August 1990. One of the main reasons for the recession: unsound real estate lending practices. The Great Recession began in 2007 after the March subprime meltdown. Easy credit, pick-a-payment plan, subprime lending, zero-down loans, easy qualifying, adjustable teaser rates, and fraudulent lending all led to the largest downturn since the depression.

When pundits start talking about a potential recession, everyone’s collective brains immediately recall the Great Recession and expect the economy and housing to behave just like it did in 2007. They forget about the other recessions where housing values continued to rise. Today’s housing has an extremely strong foundation with years of tight lending qualifications, large down payments, fixed rate mortgages, plenty of nested equity, and limited cash-out refinances.

In housing, during a slowdown, demand falls, the active inventory rises, and it takes longer to sell a home. During the Great Recession there was a glut of homes available to purchase and it was matched up with muted demand. Consequently, home values plunged. In Southern California there were nearly 120,000 homes available in 2007 compared to the 19,000 homes available today, over six times more. Today’s missing ingredient that would lead to falling home values is supply. The number of homes on the market today is far below averages prior the start of the pandemic when values were still rising, but at a much more methodical pace.

Excerpt taken from an article by Steven Thomas.