The Rate Migration

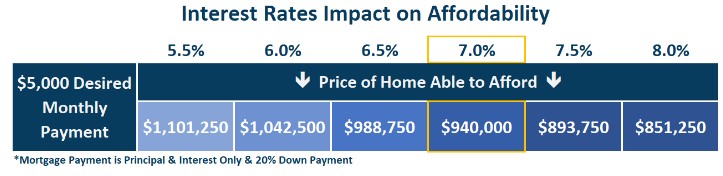

Mortgage rates have crept their way back above 7% with hotter than expected economic readings, resulting in a slowdown in purchase activity.

Airline travel is particularly sensitive to airfare pricing. There are so many online choices to compare fares easily. Travelers quickly jump for more affordable options, even if it means changing traveling dates, accepting layovers, or flying on a red-eye. When airfares spike, many travelers alter or scrap their travel plans altogether. Yet, if fares unexpectedly drop, demand soars, and flights are booked seemingly overnight. The price sensitivity of airline consumers makes it tricky for airlines to fill planes and still earn a profit.

Similarly, prospective buyers are very sensitive to how much their monthly payment will be, which is determined by the prevailing mortgage rate. Home values skyrocketed higher as mortgage rates plunged to record lows from 2020 through the first few months of 2022. That changed as mortgage rates soared from 3.25% at the start of 2022 to 7.37% by October. In 2023, rates climbed from 5.99% in February to 8% in October. They remained above 7% from the end of July 2023 through mid-December. Despite a limited supply, values do not change much when rates climb above 7%. The combination of elevated home prices and the high mortgage rate environment has resulted in an exceptionally rate-sensitive housing market.

Excerpt taken from an article by Steven Thomas.