Top 5 Trends

It is best to step back from all the narratives, opinions, and noise whirling around the housing market and focus on the trends. With a third of the year in the rearview mirror, definitive trends have emerged in 2024.

Driving a car in the middle of the night on an unfamiliar road without headlights would be challenging. For buyers and sellers stepping into the real estate scene, the countless YouTube videos, headlines, and neighborhood chatter make it as daunting as driving that car in the dark with no lights. To properly shed light on the current state of the housing market, ignoring the noise and turning to the 2024 trends backed by statistics and data will allow buyers and sellers to navigate the real scene properly.

Here is a breakdown of the “Top 5” Orange County housing trends:

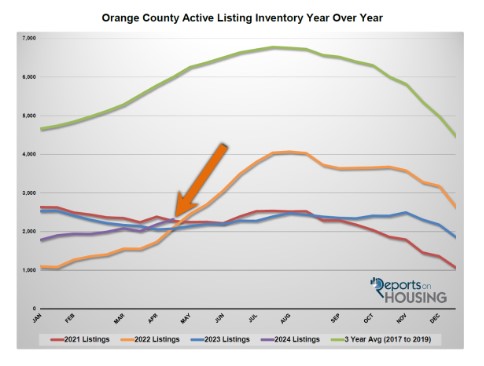

After bouncing along a record-low number of homeowners willing to sell in the high mortgage rate environment, there are finally more new sellers in 2024. Most homeowners are “hunkering down,” unwilling to move due to their current underlying, locked-in, low fixed-rate mortgage. Since 84% of California homeowners with a mortgage have a fixed rate of 5% or lower, today’s nearly 7.5% mortgage rate prevents many would-be sellers from placing their homes on the market. In 2023, 41% fewer homeowners were willing to sell compared to the 3-year average before COVID (2017 to 2019), or 16,110 missing FOR-SALE signs. That is a large chunk of the market, considering the 3-year pre-pandemic average annual residential closed sales was 29,631. In 2024 through March, there were 37% fewer homeowners compared to the 3-year average.

Excerpt taken from an article by Steven Thomas.