Mortgage Rates are 100% NOT lower this week! On September18, 2024, the Federal Reserve announced a 50-basis point (bps) interest rate cut, marking the first reduction in four years. This move, just before the presidential election on November 5, was highly anticipated. However, the impact on mortgage rates has caused some confusion among borrowers.

**The Real Impact on Mortgage Rates**

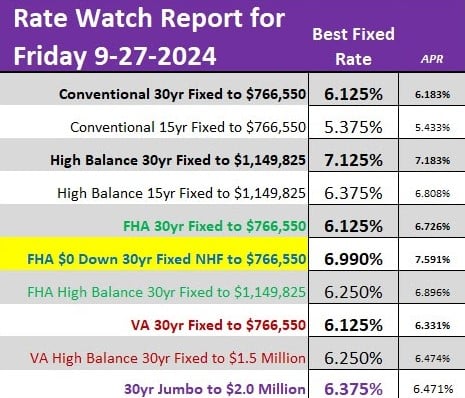

Following the Fed’s announcement, media headlines were flooded with news about mortgage rates dropping to the “lowest in two years.” Naturally, this led many borrowers to think they could now benefit from even lower rates. But here’s the catch: mortgage rates had already dropped to their lowest levels in over a year and a half **before** the Fed made their move.

**A Common Misunderstanding**

Many borrowers who waited for the Fed’s decision are now reaching out to loan officers, thinking that the rate cut means mortgage rates have dropped even further. In reality, the best rates occurred the day before the Fed’s announcement, leaving those who waited feeling like they missed out.

The Bottom Line: Today’s mortgage rates are still excellent—especially compared to just a few months ago. In July, the 30-yearfixed mortgage rate was above 7%. So, while rates may not have dropped dramatically after the Fed’s cut, they remain incredibly favorable for buyers and homeowners considering a refinance.

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com