Midyear Outlook

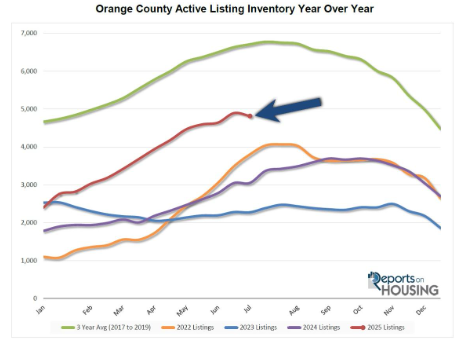

With half of 2025 in the rearview mirror, trends have developed that establish a slowing housing market, which relies on elevated mortgage rates.

The Orange County housing market will either slow further or accelerate depending on the direction of mortgage rates.

There are many crossroads in life where a single decision can take someone down a completely new path. Whether it's choosing a career, getting married, or moving to a new city, each decision shapes a unique and distinct future.

Similarly, the second half of 2025 stands at a crossroads, where the pathway of mortgage rates will result in two vastly different outcomes. Will mortgage rates remain elevated, or will they fall below 6.5% with duration? The housing market is at the mercy of rates. Until rates drop, expect more of the same.

In recapping the first half of 2025, mortgage rates started the year above 7%, according to Mortgage News Daily, and did not drop into the 6s until mid-February. They bounced between 6.6% and 6.99% ever since, except for four days when they rose above 7% due to the reaction to the tariff announcement and concerns about the deficit following the details of the new tax bill.

Excerpt taken from an article by Steven Thomas.