Mortgage Rate Watch — What’s Moving Rates Right Now

Mortgage Rates just saw their biggest drop in months after President Trump directed Fannie Mae and Freddie Mac to buy $200 billion in mortgage‑backed securities (MBS). That announcement alone pushed the average 30‑year fixed down 22 bps to 5.99%, matching the lowest level since early 2023.

Why Rates Fell

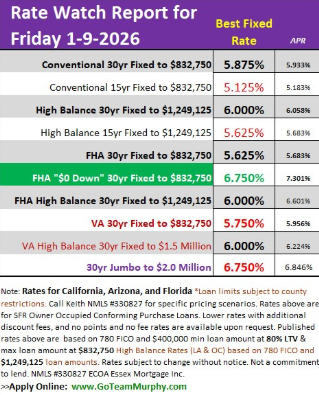

The directive boosts demand for MBS — and when MBS prices rise, mortgage rates fall. Analysts estimate the program could shave another 0.25%–0.50% off rates as it rolls out, and from today’s rates (see Rate Grid below), that would put rates solidly in the mid 5’s on most 30yr Fixed Rate products!

What This Means for Homebuyers

>A move into the high‑5s meaningfully improves affordability.

>On a $800,000 home with 20% down, today’s drop lowers the payment by roughly $260/month.

>Not pandemic‑era lows — but a real shift in buying power!

Builders & Sellers Feel It Too

Homebuilders were already using rate buydowns to keep traffic up.

With market rates dipping into the 5s on their own:

- Buyer confidence improves

- Incentives may shrink

- Builder margins strengthen

Refinance Activity Is Heating Up

Refi applications were already up 133% year‑over‑year before this announcement.

With rates now flirting with the 5s, more homeowners are crossing the threshold where a refinance makes financial sense.

Bottom Line

This is the first major policy‑driven rate improvement we’ve seen in years! If the program is implemented quickly, rates could stabilize in the high‑5s, opening the door for buyers who’ve been waiting for the right moment.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com