More taxes equals more homes for sale?

Sounds bizarre but Vancouver, British Columbia is going to try just that.

You see, they have the same problem that we have here in the US, tight inventory. With inventory levels so low, they have been struggling to find a way to get inventory controlled by “hoarders” back into the marketplace.

Vancouver is slapping thousands of empty homes with a new tax as part of a government effort to tame the out-of-control Real Estate bubble that just won’t quit there and is being closely watched by many U.S. metro markets to see if it works.

Approximately 4.6% or 8,481 homes in Vancouver have stood empty or underutilized for over six months in 2017, down from 10,800 in 2016 according to declarations submitted to the municipality by homeowners. Empty properties will be charged a 1% tax on the assessed value – not much, but with average detached home prices hovering below C$1.8 million, attached units going for C$715K and condominiums at C$571K, 1% is still a large sum of money.

The problem of a hot housing market and tight inventory levels gets even worse as foreign buyers move in which effectively takes a residence out of the market and it sits vacant as thousands of home buyers are scrambling to find a home for sale. According to local sales agents, investors from Hong Kong, Mainland China and other parts of Asia have been acquiring as much as 40% of the units going up for sale and just sitting on them afterwards.

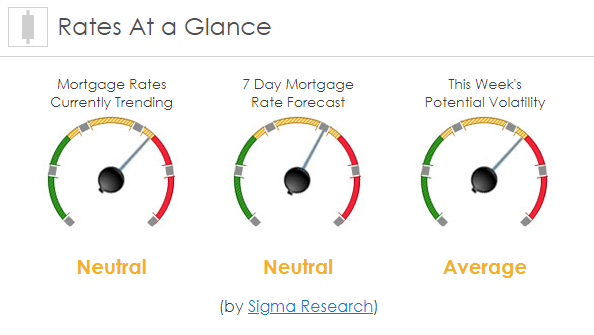

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -7bps. This probably moved mortgage rates sideways for the week. Mortgage rate volatility could be relatively high this week with all of the economic data being released.