Many buyers are sitting on the sidelines in anticipation of a major housing downturn even though the facts illustrate

it simply is not going to happen.

No Bubble: Housing data illustrates that there is not a housing bubble on the horizon.

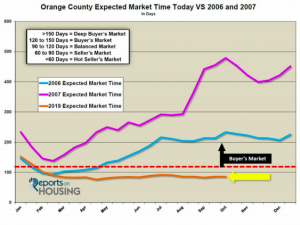

It has happened to just about everybody. Driving down the road, unaware of your current speed, a look in the rearview mirror reveals there’s a police car with sirens blazing pulling you over. After receiving the ticket and driving away, for quite some time your driving habits change. You are more cautious, more aware of your surroundings, anticipating at any moment that, inevitably, you will be pulled over again. Similarly, so many buyers and homeowners are mentally preparing for the next housing bubble to pop. Everybody knows somebody that was affected by the Great Recession when values dropped substantially, and countless homeowners lost their homes to foreclosures or short sales. With values surpassing record levels, isn’t housing a bubble again? Even though so many are anticipating another bubble, the answer is simple: NOPE. The Great Recession was prompted by the housing market where anyone could purchase a home regardless of their true qualifications. Zero down payment loans, fudged loan documents, negative ARM’s, cash out refinancing, and subprime lending contributed to the run-up in values that filled the housing bubble that ultimately burst in 2007. As a result, the housing market collapsed, and home values plummeted. The writing was on the wall prior to the collapse. Housing data illustrated market conditions that were lining up in favor of buyers. The inventory ballooned while demand crumbled. As a result, the Expected Market Time (the time between hammering in the FOR SALE sign to opening escrow) rose to ridiculous heights. The numbers were off a year prior to the subprime meltdown, which occurred in March 2007. In 2006, the Expected Market Time surpassed 150 days, a Deep Buyer’s Market, in June. It grew to 225 days by year’s end for ALL of Orange County. In 2007, it surpassed 150 days in March and by July, surpassed 290 days. By year’s end, it reached an Expected Market Time of 451 days.