HAPPY NEW YEAR!!! Now, what does that mean for Orange County real estate?

First, let’s look back at what happened in 2019 in terms of the inventory, demand, luxury properties, and Expected Market Time.

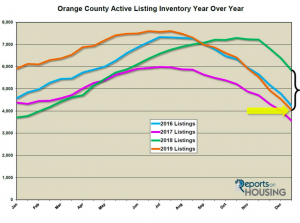

Active Inventory: After starting the year with the highest number of homes on the market since 2012, the active inventory plunged after peaking in July.

The year started with an active inventory of 5,829 homes, the highest level to begin a year since 2012. The 7,900 homes start to 2012 may have been initially high, but it continuously dropped throughout the year as the housing market had just began its recovery from the depths of the great recession. The elevated start to 2019 was entirely due to a buildup of homes in the second half of 2018. That’s when interest rates climbed all the way to 5%, its highest level since March of 2011. The higher rates muffled demand. Values had risen continuously from 2012 through the first half of 2018. As potential buyers looked at a 20% increase in payments from the start to end of 2018, they opted to sit on the fence and wait to purchase. The lack of home affordability was the main issue driving the housing market. As a result, many sellers who placed their homes on the market in the second half of the year did not find success. With fewer successful sellers, the active listing inventory continued to grow until peaking just before Thanksgiving. 2018 finished with an elevated inventory; thus, the start to 2019 was elevated as well. 2018 was the year that major cracks emerged, and it was entirely due to higher mortgage rates. Yet, 2019 was quite a different year with interest rates dropping continuously. The year started with 4.5% interest rates. They dropped to 4% by the end of May, and then dipped all the way to 3.5% by September. The year ended with rates at 3.75%. This unprecedented drop slowly translated to more and more buyer demand.