Mortgage Rates are flat to slightly better than last Friday. This is in response to yesterday’s BIG stock market sell-off that rifled through markets in the last 90 minutes of trade. Example: Netflix stock has been down as much as 25% this morning after earning announcement after market close yesterday. There is blood in the water and this is typically good for mortgage rates/bonds. I’ll be carefully watching the stock/bond market relationship closely today to see how reliant the bond market strength holds up against the continued stock market weakness this morning.

Bottom Line: Today and early into next week is a small window of opportunity to lock before rates continue their move higher. With the Fed’s accelerating the Taper sooner than expected, and then selling their balance sheet (new announcement) into the market will create an over supply of mortgages being sold which will drive bond prices lower and move rates higher. Couple this with an implied Fed Funds rate hike as soon as next month, and I think this window may close quickly.

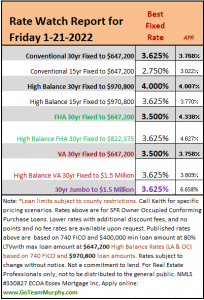

Here are Essex Mortgage best execution pricing as of 9:05am 1-21-22