Eager buyers faced with hesitant sellers

Home sales are still going strong, and the National Association of Realtors says they could have been even higher if there were more homes for sale. It seems there is a critical shortage of listings, especially in higher price ranges. And out in the trenches, homebuilders are struggling to keep up with demand amid higher land prices and labor shortages.

Homes sales in the West, where prices are highest, are seeing the biggest gains. Nationally, sales of homes priced above $750,000 were up nearly 19 percent from a year ago. New tax laws limit the mortgage interest deduction. Borrowers can now deduct interest paid on up to $750,000 in mortgage debt. Previously, the limit was $1 million in mortgage debt.

Sales for homes priced under $100,000, were down 16.5 percent compared with a year ago. This is where the supply shortage is worst.

The paradox in a market like this is that Realtors are hearing very few concerns from buyers about rising mortgage rates or the new tax laws —even fewer concerns than in December when the tax laws were in final debate. Buyers who are afraid of rates heading higher are spurred to step up and lock in with a purchase and a funding rate, according to Peter Boockvar, chief investment officer at Bleakley Advisory Group.

But that is not the case for potential sellers. Lawrence Yun, the chief economist at the NAR, speaks of the “interest rate lock effect,” where sellers are increasingly telling agents that they do not want to move because they will lose their record-low fixed mortgage rate.

”Mortgage rates are at their highest level in nearly four years, at a time when home prices are still climbing at double the pace of wage growth,” added Yun. “Homes for sale are going under contract a week faster than a year ago, which is quite remarkable given weakening affordability conditions and extremely tight supply. To fully satisfy demand, most markets right now need a substantial increase in new listings.”

Shortage on the lower end is likely why first-time homebuyers have been pulling back as affordability and supply are weighing more heavily on them now.

“To get to those levels, demand needs to stay hot, builders need to continue ramping up new home activity and more sellers need to feel comfortable selling. Threading that needle has so far proven difficult,” says Aaron Terrazas, senior economist at Zillow.

According to the latest issue of Barron’s, the new home sales boom is far from over, citing how shares of several homebuilders look attractive as the U.S. housing market could strengthen further.

With a continuing strong demand, a dearth of inventory and modest annual price gains, industry observers see this going for several years unless mortgage rates spike, according to the article.

The SPDR S&P Homebuilders (ETF) has fallen 9 percent this year. Homebuilder shares recently traded for 10 times 2018 profit estimates, compared to the overall market’s P/E ratio of 17, even though the companies are expected to have double-digit earnings growth this year and next, the article said.

As we have frequently mentioned here, the future behavior patterns of millennials are crucial in determining whether housing starts will close the gap from being 35% under the normalized trend. The resolution of the millennial question is important but hard to estimate: builders are a critical element and indicator for the economy.

Source: Thomson/Reuters, Barron’s, NAR,TBWS

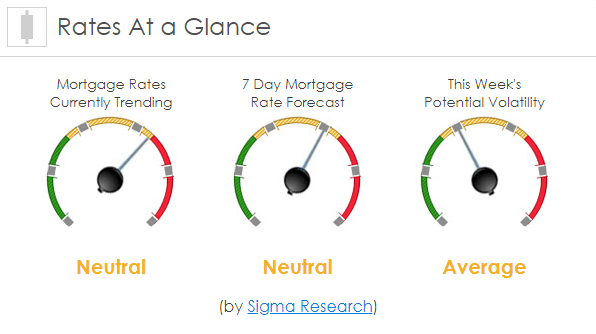

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -4bps. This wasn’t enough to move rates higher last week. Mortgage rate volatility has remained very stable while stocks have shown a great deal of volatility.