More homeowners mean fewer renters

According to the National Association of Realtors, rising wages, loosening credit standards and demographic shifts are combining to create momentum for owning a home rather than renting one.

With the homeownership rate rising for the fifth consecutive quarter, it held steady at 64.2%, unchanged from the prior quarter and its highest level since 2014. The share of Americans who own a home rose from the prior year, from 63.6% in the first quarter of 2017.

When homeownership rates rose last year for the first time in more than a decade, it marked a turning point in the recovery, during which home prices have risen sharply, and credit standards were initially very tight, blocking many renters from buying homes.

With 1.3 million owner households created over the last year and the loss of 286,000 renter households, it reveals the fourth consecutive quarter in which the number of renter households declined from the same quarter a year earlier. According to experts, this will place downward pressure on rents.

The NAR credits wages and looser credit standards have helped bolster demand for homes in the last year, while Fannie Mae made it easier for borrowers to take on more debt by the middle of last year. Demographics trends go hand in hand with all this as members of the large millennial generation are entering they are early to mid 30s, when people typically marry, have children and purchase their first home.

This trend may not last, as interest rates rise and new tax changes may diminish the benefits of homeownership. The rate for a 30-year, fixed-rate mortgage is now at the highest level since August 2013, according to data released by Freddie Mac on Thursday.

Limited inventory and rising prices are also making it difficult for the younger generation, driving fierce bidding wars and individuals able to pay cash or make large down payments, according to the NAR article, which adds, “The homeownership rate for households headed by someone 35 years or younger declined to 35.3% from 36% the prior quarter. Nonetheless, it rose a full percentage point from 34.3% in the first quarter a year ago—the fifth consecutive quarter it has gone up on an annual basis.”

It also cites that the homeowner vacancy rate declined to 1.5% from 1.7% a year earlier, according to the Census data, down significantly from the recent peak of 2.8% during the housing bust in 2008 and close to the level seen in the early 1990s, according to Tian Liu, chief economist at Genworth Mortgage Insurance.

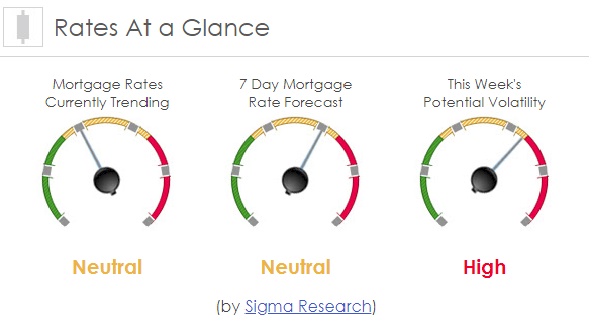

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +3bps. This moved mortgage rates sideways last week. We could see increased rate volatility this week.