DON’T BE FOOLED BY TODAY’S MORTGAGE RATES

When your clients go online to search for rates, the advertised rates are very confusing, therefore, let’s keep this short and simple. There are some major misconceptions out there today and for many of you, it’s very important to address them. What are the misconceptions?

Misconception 1: Rates are lower today than they were yesterday This one is very easy to clear up. It’s a frequent Thursday occurrence, actually. It stems from the weekly release of Freddie Mac’s mortgage market survey which admittedly only collects responses on Mon-Wed. In other words, if rates were lower on Mon, Tue, Wed this week compared to the same 3 days last week, Freddie’s survey will say as much. From there, the scores of journalists who rely on this survey for their weekly mortgage rate coverage will pump out headlines that neglect to mention the Mon-Wed caveat. The net effect is that Today’s rates could be higher than yesterday’s (and they certainly are) despite multiple news stories printed today saying the opposite.

Misconception 2: The Fed did something to suggest lower rates yesterday 8-27 The Fed DID do something. And it’s even fair to say it indicated certain rates would be lower for longer. BUT, it’s eternally and tremendously important to remember that the rate controlled and set by the Fed has almost nothing to do with the mortgage market on any given day. The Fed sets an overnight rate. Mortgages, on the other hand, last many years on average. That makes the debt associated with these rates VERY different in the eyes of investors. For instance, the Fed held its policy rate at 0-0.25% for years after the financial crisis, but mortgage rates moved up, down, sideways, and every way in between during the same time (and never went below 3%, for what it’s worth). If anything, today’s update from the Fed is arguably BAD for longer-term rates like mortgages. Long story short, the Fed confirmed its long-telegraphed plan to let inflation get higher than their previous framework allowed for. High inflation is bad for low rates (have you been watching the value of the dollar plummet?). It also connotes a higher comparative level of economic activity and employment. Those things are also not good for rates.

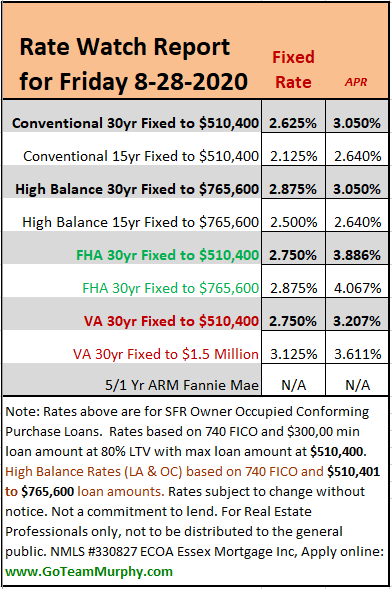

Bottom Line: there’s a risk that the market treats this as a cue to try to push longer term rates back up to the levels seen in early June. Combine that with the impending re-introduction of the much-maligned refinance fee (Essex will implement the fee again November 10th!) and there should be a real sense of urgency for those considering getting a mortgage. In the meantime, we are locking all new escrow as they open! Rates are still GREAT but they are trending higher with much volatility.

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com