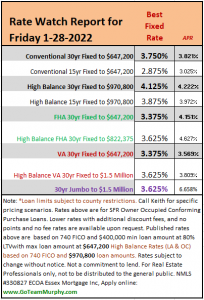

Mortgage Rates are slightly higher from last week as the trend for 2022 continues to leave uber low mortgage rates in the rear view mirror. This past Wednesday’s Fed Meeting cause investors to expect a faster pace of tightening which was the cause for rates to rise. The actual inflation and economic growth data had little to no impact on traders heading for the exits.

Why? As the Fed tapers, sells off their balance sheet (which brings excess supply to the market) and rates Fed Funds Rate, this action devalues an investors bond holdings. If you held an investment that you feared would be worth less tomorrow than it’s valued for today, wouldn’t you sell it? Well, this is exactly what bond traders are doing and the effects are snowballing. Adding fuel to the fire, Fed Chair Powell would not provide a target number of rate hikes in 2022, but he did stoke the fire (fears) when he said “there’s quite of bit of room to raise rates without threatening the labor market.”

Bottom Line: With increase uncertainty comes increase volatility and trying to time the markets swings is unnerving for most clients, we are therefore recommending clients LOCK as soon as escrow opens.