Why Today’s Mortgage Rate Headlines Are Misleading!

Mortgage Rates are fantastic and are near the lows of 2025. However, ever since the Fed cut the Fed Funds rate by 25 Bps, everyone thinks mortgage rates are .25% lower. This could not be further from the truth!

So why the confusion? It starts with Freddie Mac! You see, every Thursday, Freddie Mac releases its weekly mortgage rate survey—and every so often, we need to clear up the confusion it creates. Today is one of those days.

Freddie’s report is landing just one day after a Fed rate cut, and headlines are already claiming mortgage rates have dropped to the lowest levels in over a year. Sounds great, right? Not so fast.

Rates were at those lows—on Tuesday. But since then, daily averages have jumped by 0.20%, marking the fastest two-day spike since the last Fed cut. That’s no coincidence.

Here’s the truth: mortgage rates react to economic news before the Fed makes its move. By the time the cut happens, the market has already priced it in. The Fed Funds Rate isn’t the same as mortgage rates, except in limited cases like HELOCs tied to Prime.

So why does Freddie’s data look so off? It’s not wrong—it’s just late. Their survey averages rates from last Thursday through Wednesday, and most of those days saw ultra-low rates. Yesterday’s spike came too late to affect the numbers.

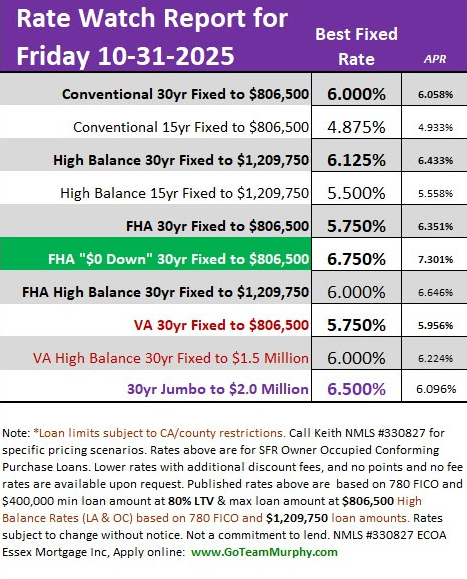

Bottom line: Today’s headlines are quoting outdated data. Mortgage rates are already climbing, and if you’re relying on Freddie’s Thursday snapshot, you’re looking in the rearview mirror. Reminder, rates are still fantastic!

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com