Housing market showing signs of stability at last

It’s finally getting normal around here. According to a recent analysis by Realtor.com’s Andrea Riquier, there’s fresh evidence that the housing market is gaining some stability after some crazy years of multiple offers that resulted in inflated pricing in many markets.

You can’t argue with the Census Bureau, which says the national homeownership rate was 64.4% in the third quarter, a half-percentage point higher than a year ago. That may not sound like much, but if you study the numbers, it’s a big deal.

“After touching an all-time high of 69.1% in 2004 as the housing bubble inflated, the homeownership rate bottomed out at 62.9% in 2016 as waves of Americans lost their homes or sold under duress,” says Riquier. “At the same time, many Americans who would ordinarily become buyers were locked out of the market by stringent lending rules, a lack of affordable inventory and a challenging economic backdrop.”

Over the past 12 months, 1.77 million more Americans became owners, while the number of renters declined by about 100,000, adds Riquier in a MarketWatch report. “Even better, the biggest jumps in ownership were among younger people. For those under 35, 36.5% were owners in the second quarter, compared to 35.3% a year ago. Americans age 35 to 44 saw a correspondingly hefty jump, to 60% from 58.8% in 2017.”

This all points to a potential moderation in home prices going into 2019, which some analysts believe came from would-be buyers pushing back against hefty price gains, helped many of them finally become owners.

While there’s a lot of speculation about what made this happen, the meager recovery to this point puts the homeownership rate only back to 1995 levels, well before the run-up to the 2008 bubble, suggesting it may be possible for many more Americans to become owners providing market conditions ease further. The vacancy rate for owners was just 1.5% for the second month in a row, tighter than the 1.6% it averaged throughout 2017.

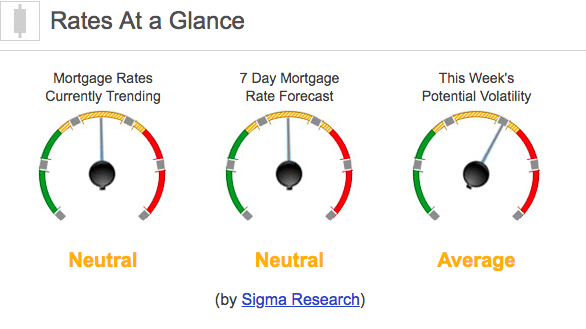

Rates Currently Trending: Neutral

Mortgage rates are trending sideways so far today. Last week the MBS market improved by +65bps. This was enough to move rates lower last week. We saw high rate volatility at the end of the week.