Buying a home in 2020 depends on your financial health habits

If home-buying is on your radar in 2020, it should be more than a passing thought. Unlike previous years when you may have made a snap decision to buy a car or take a trip, you should be preparing for it with nearly every financial decision you make.

ZillowPorchlight’s Alexa Fiander suggests some New Year’s resolutions to keep your financial resume in great shape:

“Employment history and income are two of the biggest factors lenders look at when evaluating a mortgage application,” says Fiander. “A new job may be a good career move, but if you plan to buy a home in the new year, know that job-hopping can be a red flag to some underwriters — especially if you’re moving to a different industry.” If you’re looking around for something new, keep those plans for after you close escrow on a home. Job stability is king with lenders, who will also scrutinize any gaps in employment over the past two years. They must feel you are an excellent risk before approving your loan.

If, however, you make an employment change after applying for a loan, let your lender know ASAP, as they will need extra documentation. Verifications for reserve funds, employment status, and a credit check are usually done at the beginning of the loan application process as well as at the end, so it’s best to freeze everything in time if possible. Lenders like steady, predictable paychecks.

While a good credit score is vital, credit utilization reveals a lot about your spending habits. Even if you pay off your credit card every month, you could be dinged for high credit utilization if your credit report is pulled mid-cycle. That old adage your parents used to use — “credit cards are for emergencies” might apply now. “Lenders prefer borrowers who have a history of paying off credits cards and other debts on time — because it signals that you’re a responsible borrower and less of a risk,” says Fiander.

What? No credit at all? You’d think lenders would be okay with that, since there is no history of financial mistakes, late fees, etc. but you’d be wrong. “If you don’t have credit, securing a home loan may be significantly more challenging and time-consuming, but not impossible,” says Fiander. “Records of paying rent and utilities on time, as well as student loan debt or cell phone bills, can help show a potential lender that you have a history of managing monthly payments.”

As you prepare for a home purchase, consider checking your credit score as if you’re checking the scale while on a diet, since your credit score can have a significant impact on your ability to buy a home. The lower the score, the higher the interest rate that might be available to you. “Just a few percentage point differences in an interest rate can cost you thousands over the life of a loan. Monitor your credit closely, especially for fraudulent activity, to prevent any surprises that could delay the loan application process,” says Fiander.

Just because you aren’t a credit card junkie doesn’t mean other financial decisions won’t make an impact. The moment you submit your loan application, it’s best to avoid taking on large amounts of debt, such as a car purchase or a family reunion in Tahiti. Your pre-approval may be affected by not waiting until escrow is closed.

Of course, if you have any questions about your situation, reach out. We’re here to help.

Source: Zillow, CoreLogic, TBWS

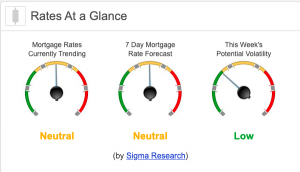

Rates Currently Trending: Neutral

Mortgage rates are trending sideways so far today. Last week the MBS market improved by +18bps. This may’ve been enough to move rates slightly lower. Rates continue to move mostly sideways on very low volatility.