Millennials have a lot of misconceptions about what is required to buy a home

|

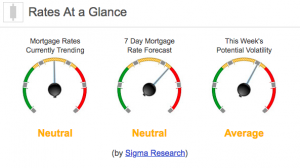

Rates Currently Trending: Neutral

Mortgage rates are trending sideways to very slightly lower so far today. Last week the MBS market improved by +44 bps. This was enough to move rates lower last week. We saw moderate to low rate volatility throughout the week.