Mortgage Rates are even HIGHER than you have been told this week. First off, I apologize. You’re right. How would I know exactly what you’ve been told about mortgage rates today? I can only draw the same sort of general conclusion based on my conversation with 8 new buyers this week who were not aware has happened this week!

My conclusion of this disconnect is due to an abundance of mortgage rate coverage hitting the presses today suggesting rates are “only” up about .2% from 6.12 to 6.32. We know that much is true because that’s the change published in today’s Freddie Mac survey. News media and even the housing/mortgage industries rely heavily on Freddie’s survey to provide an authoritative weekly update on rates.

Freddie’s survey isn’t bad or inaccurate. It’s just stale. Due to its methodology, it is essentially a measure of this past Monday’s rates versus the previous Monday, but not reported until Thursday. At that point, news organizations write their stories on rates and consumers read the coverage on Thursday afternoon or Friday morning.

Unfortunately, the media coverage gives consumers the impression that rates are still where they were on Monday. They’re not… Mortgage rates can change much more quickly than many people realize, and the past few weeks have been great examples!!

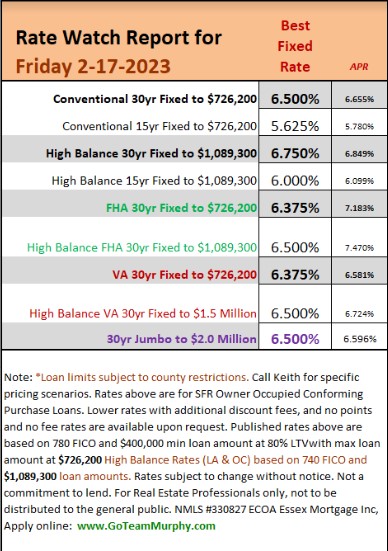

In fact, it was EXACTLY 2 weeks ago (Thursday, Feb 2) that the average lender could offer 5.99% on a top notch conventional 30yr fixed mortgage. Today, that same lender would be closer to 6.75-6.875%.

This is an incredibly abrupt move at almost any other time in the past several decades. The only reason we’re not freaking out is that this sort of volatility has been common at times over the past year. Moreover, the most recent highs saw rates well into the 7% range, so if we’re still in the 6’s, rising rate headlines don’t have a ton of shock value.

So don’t be shocked, but do be aware that rates are quickly closing in on 7% again.

But why?

Bottom Line: It all has to do with data and the Fed’s reaction to it. Specifically, the rate market was more optimistic than it should have been according to the Fed. After the jobs report on Feb 3 and inflation data on Feb 14, the market has quickly been moving to fall in line with the Fed’s higher rate expectations.

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com