Rates Flat, but Still Low!

Mortgage Rates are flat when compared to last Friday. While there have only been 9 trading/business days this month, today marks the first time during that stretch where mortgage rates haven’t improved from the previous day for the average lender. That’s the less-than-ideal news.

However, the good news is the average lender’s 30-year fixed conventional mortgage rates are at their lowest levels since February 2023! That’s a significant drop—over 0.75% in just a little more than a month, which is a notable pace of improvement. This also marks the longest rate improvement streak in more than three years.

In financial markets, extended periods of favorable trend soften spark concerns about a potential reversal. While a rate uptick is possible, it largely hinges on upcoming economic data and the market’s response to the Federal Reserve’s rate outlook next week.

Bottom Line: It’s important to note that we’re less focused on the Fed’s rate cuts themselves, as those expectations are already factored into today’s mortgage rates. What really matters is how aggressively the Fed signals future rate cuts. If they suggest a more robust outlook for cuts, mortgage rates could continue to decline. On the other hand, if their stance is more conservative, rates may hold steady or even rise slightly, depending on how the economic data unfolds.

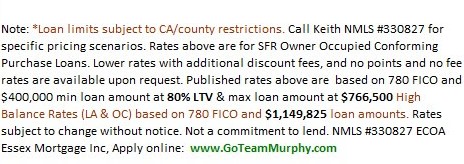

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com