Mortgage Rate Watch — Jan 10 to Jan 16, 2025

Mortgage Rates drifted slightly higher or flat (depending on product) since last Friday but overall stayed inside a familiar range. The moves were small, driven mostly by normal bond‑market fluctuations and softer MBS pricing.

Rates: Mild Upward Pressure, Still Stable

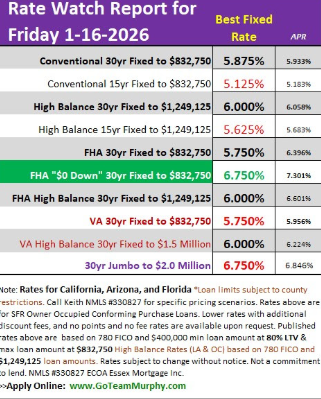

Rates ticked up a touch across the board:

- 30‑year fixed: modest increase

- 15‑year fixed: modest increase

- FHA & VA Government‑backed loans saw similar small bumps

These are incremental changes — nothing that shifts affordability in a meaningful way.

MBS: Slight Weakness = Slightly Higher Rates

Mortgage‑backed securities (MBS) slipped this week, and that’s the main reason rates nudged higher.

A simple way to understand it:

- When MBS prices fall → rates rise

- When MBS prices rise → rates fall

This week, MBS saw some selling pressure and were a bit weaker, so rates moved up accordingly.

What Drove the Movement

- Mixed economic data created a blend of upward and downward pressures

- No major Fed announcements, so markets reacted mostly to routine reports

- Treasury yields bounced around, keeping mortgage rates in a tight band

Nothing in the news created a breakout — just normal week‑to‑week rate noise.

Bottom Line

Rates are slightly higher than last Friday, but still steady and predictable.

Some indicators continue to point toward potential downward pressure ahead, so buyers and refinancers should stay alert — small dips can create great lock opportunities!

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com