Mortgage Rates Nosediving to Fall of 2024 Levels!

Mortgage Rates have taken a significant dip, reaching levels not seen since Fall 2024. This shift comes in the wake of a disappointing August jobs report, which has heightened expectations for Federal Reserve interest rate cuts.

Key Highlights:

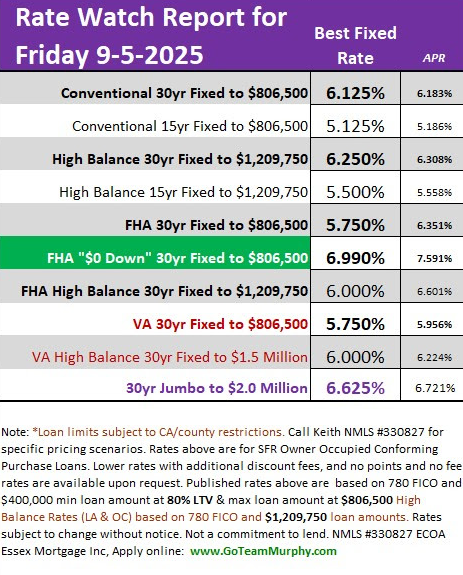

- 30-Year Fixed Mortgage Rate: Dropped to an average of 6.125%, down from 6.45% the previous day.

- 30-Year FHA & VA Mortgage Rate: Dropped to 5.75%

- August Jobs Report: Only 22,000 jobs were added, significantly below the forecasted 75,000.

- Unemployment Rate: Increased to 4.3%, marking the highest rate in four years.

The bond market reacted swiftly to the weak employment data. Investors moved towards safer assets, causing bond prices to rise and yields to fall. This inverse relationship between bond yields and mortgage rates led to the observed decrease in mortgage rates.

With the Federal Reserve's next meeting scheduled for September 17, the market is now pricing in a 100% probability of a rate cut, with discussions of multiple cuts by year-end.

Bottom Line: For prospective homebuyers and those considering refinancing, this development presents a potential opportunity. However, it's essential to stay informed, as upcoming economic indicators could influence future rate movements.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com