Mortgage Rates Are Easing

Mortgage Rates Are Easing

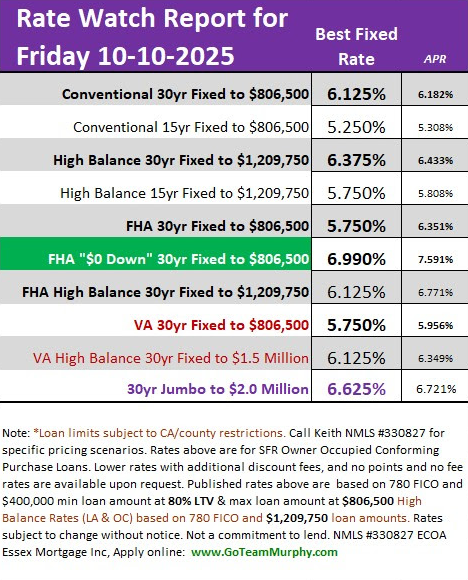

Mortgage Rates are holding steady near recent lows! In fact, the average mortgage rate is .01% lower when compared to last Friday. Technically, this is very bullish considering the US Government is shut down, and the market is showing signs of calm after a rollercoaster year.

What’s Driving the Change?

What’s Driving the Change?

The Federal Reserve recently cut interest rates, which helps ease borrowing costs. Bond traders are expecting 2 additional rate cuts this year, driving a bond rally.

Investors are feeling more confident, which is stabilizing the mortgage-backed securities (MBS) market.

Treasury yields are dipping, which often leads to lower mortgage rates. Today, this is being helped by POTUS posing “massive” new Tariff on China.

Translation? The financial gears are turning in favor of Lower Rates!

What You Can Do Right Now

What You Can Do Right Now

Get pre-approved if you’re thinking about buying >> rates like these don’t always last.

Review your current mortgage to see if refinancing makes sense.

Talk to a trusted mortgage advisor (like me!) to explore options tailored to your goals.

Final Thought

Final Thought

Markets change. Life changes. But when opportunity knocks, preparation makes all the difference. Whether you’re just starting your journey or planning your next chapter, today’s rate environment is a reminder that your dreams are still within reach.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com