Mortgage Rates Nearing Long-Term Lows!!

Mortgage Rates Slide Despite Quiet Headlines

Mortgage Rates Slide Despite Quiet Headlines

Mortgage Rates downward movement this week came with a twist: no major headlines, no blockbuster data—yet we saw two notably active days in the bond market. In fact, a partial government shutdown has delayed key data releases like the Consumer Price Index (CPI) which typically influences rate direction.

Why Rates Are Slipping Without Big News

Why Rates Are Slipping Without Big News

Here’s what’s driving the quiet improvement:

Market anticipation: With inflation data delayed, investors are speculating that upcoming reports may show cooling prices.

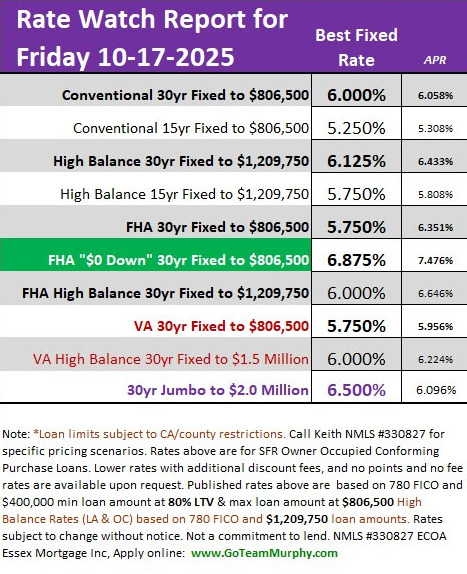

Technical momentum: As rates approach key psychological levels (like 6.125%), lenders often adjust pricing more aggressively.

Flight to safety: Ongoing geopolitical uncertainty and mixed economic signals are pushing investors toward safer assets like bonds, which boosts MBS prices.

Slippery Slope or Temporary Dip?

Slippery Slope or Temporary Dip?

Bottom Line: If you’re house hunting or considering a refinance, this week’s rate dip could be a window of opportunity. While no one can predict where rates will go next, the recent trend suggests lenders are becoming more responsive to even modest bond market gains.

That said, volatility remains high. With CPI data and Fed commentary on the horizon, next week could bring sharper moves—up or down.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com