Mortgage Rate Recap: Thanksgiving Week Through Early December

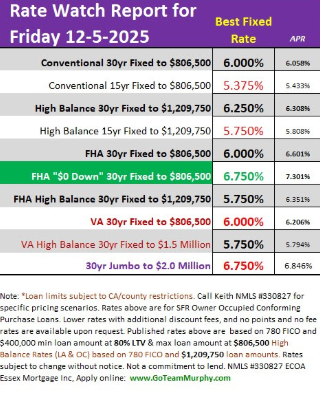

Mortgage Rates stayed relatively steady through the Thanksgiving holiday, with only modest movement as markets reopened. On November 24 (the day before the holiday weekend), the average 30‑year fixed mortgage rate was about 6.25%–6.33%. By December 5, rates had nudged slightly higher, hovering near 6.4%–6.5%. Fifteen‑year loans held in the 5.6%–5.7% range.

What Drove Rates This Week

If there’s one resounding theme in the bond market this week, it’s that trading momentum marched to its own beat with almost zero regard for the available economic data.

- Midweek Disconnect: On Wednesday, markets barely reacted to the ADP employment report or ISM manufacturing data.

- Stale Inflation Data: Friday’s PCE release was delayed from September, making it largely irrelevant for traders.

- Consumer Sentiment: The only other report—Consumer Sentiment—rarely moves markets, and this week was no exception.

- Result: The past five days marked a casual return to the prevailing range, with\traders essentially ignoring the data and waiting for bigger catalysts.

What’s Next

This quiet stretch sets the stage for more decisive moves in the weeks ahead:

- Fed Meeting (next week): Markets will be watching closely for signals on rate policy heading into 2026.

- Jobs Report (the week after): A strong or weak labor print could break rates out of their current holding pattern.

Bottom Line: With the Fed meeting and jobs report on deck, expect the next big moves in mortgage rates to come soon!

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com