Mortgage Rates & The Fed: What Really Happened This Week

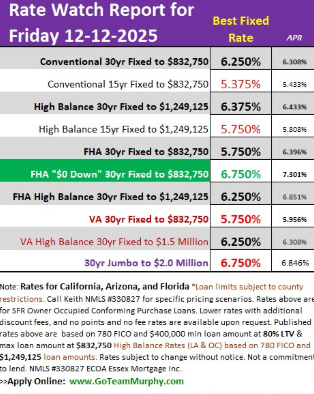

Mortgage Rates are flat to par when comparing to last Friday, but The Fed cut rates on Wednesday — so why didn’t mortgage rates didn’t fall further.

Before the Fed Cut: Traders Moved Early

Markets were already pricing in the rate cut days in advance, so traders positioned ahead of time:

- Short‑term bonds stayed stable because the Fed controls those.

- Long‑term bonds (like the 10‑year Treasury) sold off, pushing yields higher.

- Higher yields = higher mortgage rates, even before the Fed made its announcement.

After the Fed Cut: The Tone Mattered More Than the Cut!

The cut itself wasn’t a surprise — but the Fed’s comments were. Uncertainty around inflation and the labor market made investors demand higher returns on long‑term bonds. That pushed MBS prices down and mortgage rates up, despite the Fed lowering short‑term rates.

Why Mortgage Rates Didn’t Drop Further?

Mortgage rates follow long‑term bonds, not the Fed Funds Rate.

So even when the Fed cuts, mortgage rates can rise if investors expect:

- Stickier inflation

- Stronger economic data

- More volatility ahead

That’s exactly what happened this week.

Bottom Line:

The Fed cut the Fed Funds Rate, but mortgage rates are reacting to the bond market, not the headline. Expect rates to move with upcoming inflation and jobs data, plus Fed announcements.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com