Mortgage Rate Update: Why Rates Have Been Bouncing Around Since Last Friday

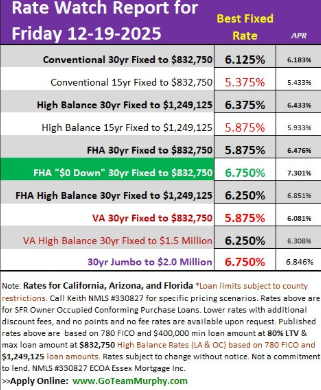

Mortgage Rates are touching lows of 2025 but have felt a little jumpy over the past few days. The bond market has been shifting just enough to nudge rates around — not dramatically, but enough for borrowers to notice.

MBS Prices Dipped Slightly

Mortgage‑Backed Securities (MBS) are the bonds that directly influence mortgage rates. Since last Friday, MBS prices have slipped a bit, which puts mild upward pressure on rates.

Treasury Yields Moved Higher

The 10‑year Treasury yield — a major benchmark for mortgage rates — has ticked up. When Treasury yields rise, mortgage rates usually follow.

What’s Driving the Movement?

No single dramatic headline — just a mix of:

- Shifting investor sentiment

- Expectations around inflation and Federal Reserve policy

- General weakness in the bond market

*These small changes add up and cause lenders to price cautiously.

Bottom Line (Friday → This Morning)

- MBS: Slightly lower

- Treasury yields: Slightly higher

- Rates: Mild upward pressure, but no major spike

- Market tone: Cautious, sensitive to economic data

What This Means for Borrowers

Rates haven’t surged, but they’re moving enough that timing matters. If you’re shopping for a mortgage, stay in touch with your loan advisor and be ready to lock when you see a number you like.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com