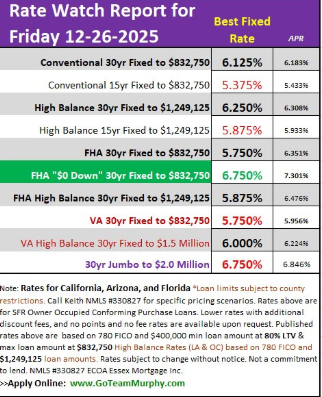

Lowest Rates in 30 days!!

Mortgage Rate Watch: What Changed Since Last Friday?

Mortgage Rates are hitting lows for the month. As we wrap up the holiday week, it’s a good time to look at how the mortgage‑backed securities (MBS) market — the engine behind mortgage rates — has moved since last Friday. Even during a short trading week, the bond market can shift enough to impact rate sheets.

- MBS Prices Improved Modestly This Week

According to the latest MBS dashboard data, MBS prices are “moderately stronger today”, which is the market’s way of saying bonds gained some ground.

Why does that matter?

- When MBS prices rise, mortgage rates tend to fall.

- Even small improvements can translate into slightly better pricing or reduced lender credits.

This week’s movement wasn’t dramatic, but it was positive — especially considering the light holiday trading volume.

- Last Friday vs. Today: A Quick Comparison

Last Friday, MBS pricing was relatively flat, with no major economic releases pushing markets in either direction. Since then:

- MBS prices have ticked higher

- Treasury yields have held steady, helping support rate stability

- Rate sheets today look slightly better than they did last Friday

This aligns with the MBS dashboard’s note that today’s trend is “positive minimal”, meaning the market is leaning in a favorable direction without a major rally.

- What This Means for Mortgage Rates

Because MBS prices improved:

- Rates today are slightly lower than last Friday

- Borrowers may see ⅛% better in rate or improved lender credits

- Locking today is marginally more attractive than heading into last weekend

This isn’t a big swing — think “gentle tailwind,” not “full‑blown rally” — but it’s still a welcome move for buyers and refinancers.

- Why the Market Moved

Holiday weeks tend to bring:

- Lower trading volume

- Less volatility

- Fewer economic catalysts

With no major surprises in inflation or employment data, bonds were able to drift slightly stronger. The market is also looking ahead to early‑January economic reports, which historically set the tone for Q1 rate trends.

- Bottom Line:

Mortgage rates are a touch better today than they were last Friday, thanks to modest strength in the MBS market. If you’re shopping for a home or considering a refinance, this week offered a small but meaningful improvement.

As always, the next big moves will come from early‑January economic data — especially jobs and inflation — so staying nimble is key!

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com