MOST MORTGAGE RATE HEADLINES ARE WRONG TODAY!

There are quite a few more new stories than normal about ![]() mortgage rates in the news. Most of them are wrong. This one is not, and it’s pretty easy to see why.

mortgage rates in the news. Most of them are wrong. This one is not, and it’s pretty easy to see why.

Freddie Mac releases its weekly mortgage rate survey every Thursday morning. The survey accepts responses from Monday through Wednesday, but based on a comparison of day-to-day rates versus the survey numbers, it would appear Monday’s rates get most of the weight, Tuesday’s slightly less, and Wednesday’s almost none. In other words, the survey has historically compared Mon/Tue rates to Mon/Tue rates.

That’s not a problem if that was made more clear by the throng of journalists that cite the survey as the definitive word in week-over-week rate movement. As it stands, however, we have headlines unequivocally proclaiming mortgage rates are at all-time lows “right now.”

They’re not… They’re close in the bigger picture, but most assuredly no longer at all-time lows. Go back to Tuesday morning, however, and sure! The average lender was indeed at all-time lows. Things deteriorated a bit since then and the average lender has nudged up just a bit in terms of rate.

Many borrowers wouldn’t see any different in the interest rate side of the mortgage rate equation, but there’s another side: upfront costs. The upfront costs associated with any given rate allow for finer tuning of mortgage interest. In other words, sure, you may still be at Tuesday’s rates, but if you’re paying $1000 more in closing costs, are you really? Spoiler alert: no, your actual APR (annual percentage rate) is now higher than it was before, despite the “note rate” on your loan being the same.

For the average reader, this point of order is relatively insignificant. But for those with loans in process or considering applying, it’s very important. Simply put, if you explored rate options earlier in the week, and then you saw today’s articles proclaiming “new all-time low rates,” just know that those headlines would need a time machine to be relevant. Rates certainly aren’t “high,” but they are higher than they were on Tuesday.

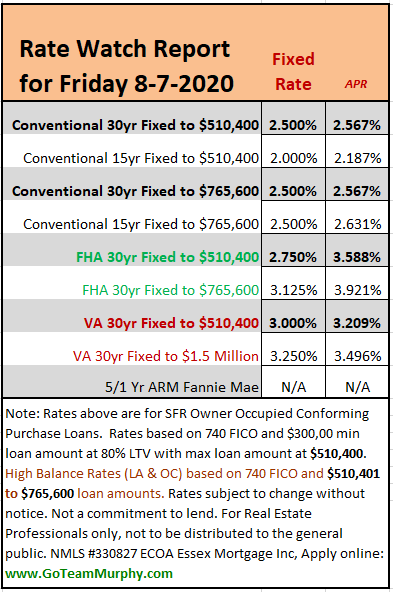

If you are talking rates with your clients, my advise is to refer them to me so I can explain and show them “in detail” all the intricacies that go into a rate quote. They will get accurate information and it will reflect well on you.

Bottom Line: Rates are still amazing! Let’s open more escrows!

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com