Will it Slow in 2022?

February 23, 2022

Housing has only grown hotter despite mortgage rates rising considerably since ringing in a New Year, indicating it will take further changes for the market to slow.

Market Shifts

If mortgage rates rise above 4% and remain elevated with staying power, then housing will finally slow a bit, shifting from an Insane Seller’s Market to a regular Hot Seller’s Market with longer market times.

The trend in rising rates has occurred before and eventually led to a market change in 2013 when there was a very limited supply of available homes to purchase as well. Similarly to today, the Expected Market Time dropped, and the market got hotter at the beginning of the year. It declined from 47 days in January to 33 days by mid-March. At the same time, mortgage rates rose from 3.34% to 3.63%, yet the market just got hotter. But, as more homeowners came on the market during the spring, the number of available homes began to rise substantially for the first time in nearly two years, growing from 3,183 in March to 4,423 by mid-June, adding 1,240 homes, up 39%. At the same time, mortgage rates had climbed to 3.93%. The inventory continued to grow through the Summer and Autumn Markets and did not peak until mid-October at 6,350 homes. A typical peak occurs during the summer between July and August. From March to October the number of available homes had soared from 3,183 to 6,350, almost doubling by adding 3,167 homes. The Expected Market Time slowed from 33 to 82 days, and mortgage rates had surpassed 4.5% in September before retreating to 4.23% by mid-October.

The fundamental trend of persistent rising rates from 3.34% at the start of 2013 to 4.5% in September, paved the way to a shift in the market from an Insane Seller’s Market to a Slight Seller’s Market. Demand downshifted due to enduring climbing rates. With a bit less demand, overpriced listings sat on the market and accumulated over time, allowing for the inventory of available homes to rise. With a rising supply and muted demand, the overall speed of the market slowed, and Expected Market Times climbed.

For the market in 2022 to experience a similar shift. Mortgage rates cannot substantially drop from here. They must persist at these higher levels, between 3.75% and 4%, and then eventually climb above 4% with staying power. If that occurs, as more homes come on the market during the spring and summer, demand will be muted, and the inventory will substantially climb for the first time in 3-years. Higher rates must endure for that to occur.

Last year mortgage rates started the year at 2.65% and had climbed to 3.18% by April 1st, up a little over a half a percent. The rise was short lived as mortgage rates dropped back down to 3% by the end of April, and to 2.77% in August. Rising rates did not persist and the Insanely Hot Seller’s Market could not be stopped.

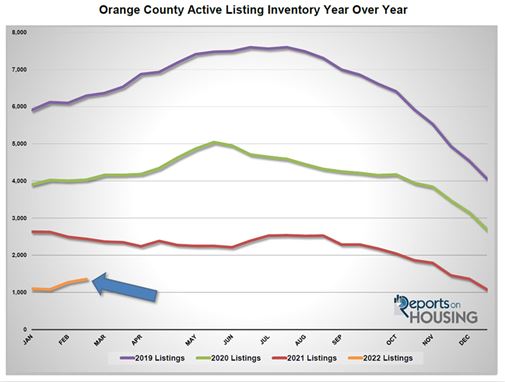

The Orange County housing market has been below 40-days since August 2020. At these levels there are a ton of showings, sellers get to call all the shots during the negotiating process, multiple offers are the norm, and home values are rising rapidly. At this point, only higher rates can slow the housing freight train that has been barreling down the tracks for nearly two years.