Rising Rates Vs. No Inventory

January 26, 2022

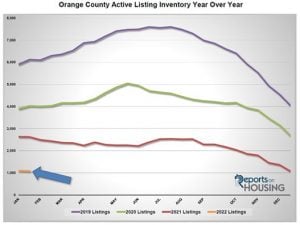

There are two opposing economic forces impacting thehousing market right now, rising mortgage rates and a recordlow supply of homes available to purchase.

Opposing Forces

There simply are not enough homes available for buyers and rising rates have not yet had an impact on the insanely hot housing market.

There is an impact to rising rates. The rise from 3.05% to 3.56% is an additional $252 per month for a $900,000 mortgage, or $3,027 per year. However, with such a limited supply of available homes the impact is not being felt on the street. Today’s rate may be the highest since the start of the pandemic, but it is still a really great rate. The extra $252 per month is more of a “market adjustment fee” for housing that is easily absorbed due to the extremely limited number of homes available. Homes are still flying off the market as fast as they are coming on. Throngs of buyers are waiting in lines for the opportunity to see a home that is placed on the market. Multiple offers are the norm. After receiving 10, 20, or 30 offers on a home, the sellers are calling all the shots, sales prices exceed their asking prices, and home values continue to rapidly rise.

Why has the rise in rates not yet affected the housing market? The answer is simple: rates have not climbed high enough to materially slow demand. Mortgage rates climbed considerably in both 2013 and 2018, which caused a shift in the market. Demand cooled, the inventory increased, market times grew, and the market slowed from a Hot Seller’s Market to a much more balanced market. In 2013, rates rose from 3.34% to 4.57%, and in 2018 they rose from 3.99% to 4.94%. The recent runup in rates is much smaller. If they continue to climb, then the market could cool. But, for now, Wall Street and investors have digested future Federal Reserve moves and they most likely will not rise much more from here. Rates would need to climb to 4% or higher to slow housing. At 4%, the difference in payment for that same $900,000 mortgage example would be $478 more per month, or $5,739 per year. At 4.25%, it would be $608 per month, or $7,299 per year.

The recent four week rise in mortgage rates had no real impact on the current pace of housing. It will be important to watch how mortgage rates unfold in the weeks and months to come. Until rates rise substantially from here, it is business as usual, an insanely hot housing market in Orange County.