What a Difference a Year Makes

In comparing this year to last year, the housing market is profoundly different with higher mortgage rates, more available homes, much lower demand, and significantly longer market times.

The tell-tale signs that the market has changed are all here. OPEN HOUSE directional arrows now adorn busy intersections, and it is common to see the same OPEN HOUSE for multiple weekends in a row. The number of price reductions is rapidly growing, indicating buyers’ sensitivity to pricing. Sales prices are no longer stretching tens of thousands of dollars above asking prices. The heydays of 2020, 2021, and the first few months of this year are gone. The rapidly appreciating, insanely hot housing market has transformed into a completely different, much slower Slight Seller’s Market that requires a much different strategy and approach to find success.

The Orange County housing market has transitioned from an Expected Market Time (the number of days between hammering in the FOR-SALE sign to opening escrow) of 19 days in March to 72 days today. Anything below 60-days is considered a Hot Seller’s Market. Below 40-days is insane, and at 19-days it is nothing short of nuts, almost instantaneous. That is where buyers trip over each other to see every home that enters the fray, sellers call all the shots, multiple offers and bidding wars are the norm, and home values uncontrollably skyrocket higher. Yet today, the Expected Market Time has risen to 72 days, a Slight Seller’s Market, where sellers still get to call more of the shots, but there are fewer multiple offers, home values are not appreciating that fast, the market is no longer instant, and properly pricing is absolutely crucial to find success.

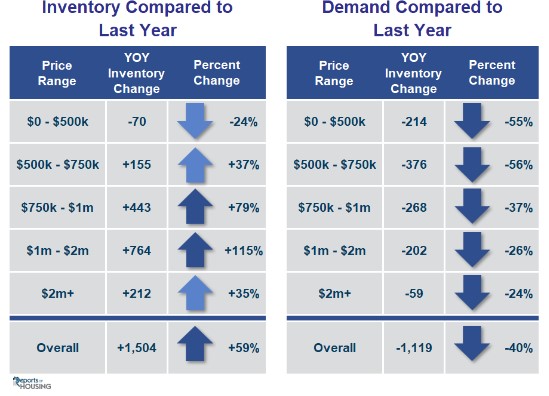

What happened in just a few short months? When mortgage rates climbed from 3.25% at the start of the year to over 6% in June, home affordability took a massive hit, buyers backed off, and demand dropped. Year-over-year, demand (the number of pending sales over the prior 30-days) is down by 40%, or 1,119 fewer pending sales. In fact, Orange County demand is at its lowest level since tracking began in 2004, slightly lower than the start of the housing meltdown in 2007. It is down in every price range, including luxury, due to Wall Street volatility. Demand is down the most (by more than 50%) in the lower price ranges, homes priced below $750,000, where higher mortgage rates and qualifying for loans has had a deeper impact.

Excerpt taken from an article by Steven Thomas.