Go for Gold – Don’t Wait

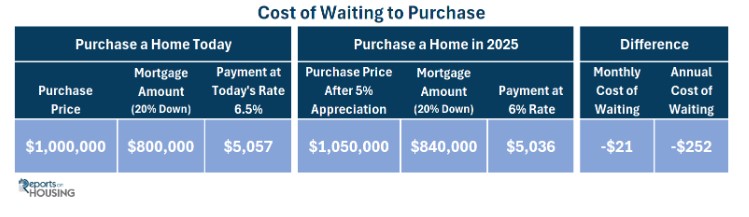

Mortgage rates have plunged from 7.5% in April to 6.34% today, opening up a window of opportunity for buyers who should not wait. Since rates have dropped in anticipation of future Federal Reserve rate cuts, now is the ideal time, and waiting will prove to be the incorrect strategy.

Olympic gold medal winners perfect their game plans and execute precise timing and strategy to succeed. On the track, many runners wait too long for their final push and cross the finish line out of medal contention. The commentators exclaim that they “should have gone sooner.” The athletes are left second-guessing themselves, wishing they had not waited.

Many buyers have been sitting on the sidelines, waiting for rates to come down. Now that rates have plummeted from 7.5% in April to 6.34% today, according to Mortgage News Daily, many buyers wonder if they should pull the trigger and purchase now or wait for rates to fall further. Sitting on the fence and waiting will prove to be the incorrect strategy, leaving many to wish that they had bought sooner.

Long-term, 30-year mortgage rates move ahead of the Federal Reserve Rate cuts. The Federal Reserve (Fed) has not cut rates once since the historical increases from 2022 through 2023, yet mortgage rates have moved all over the place, even eclipsing 8% last October. The movement is based on where investors believe the direction that the Fed’s short-term Federal Funds rate policy will move.

Excerpt taken from an article by Steven Thomas.