Light at the End of the Tunnel

Every quarter of a point drop in rates improves affordability dramatically, and today’s 30-year mortgage rate is nearly three-quarters of a percent lower than last year.

Mortgage rates have been between 6% and 6.5% since September 3rd, nearly three months, the lowest level in over a year.

In September, the sun was setting at 6:30 PM, temperatures reached the 90s, and there was no trace of rain. Now, in late November, clocks were turned back an hour, the sun sets at 4:45 PM, temperatures have averaged in the upper 60s, and rainfall totals have exceeded five inches this month alone. There’s a chill in the air, and shorts and t-shirts have been replaced with jeans, long-sleeved shirts, and everyone’s favorite fall sweater. Day by day, inch by inch, as the sun set earlier and earlier, the weather grew considerably colder. The transformation sneaked up on everyone.

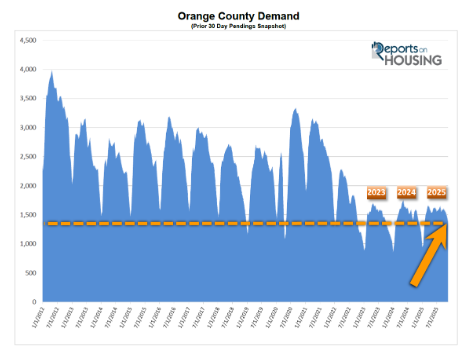

That is precisely what is occurring in the Orange County housing market. At the end of May, mortgage rates eclipsed 7%. They dropped under 6.75% in June and below 6.5% at the start of September. They have hovered between 6.13% and 6.38% for nearly three months, the longest stretch below 6.5% since August 2022, when rates were last below 6% for an extended period. Today’s lower mortgage rates have changed the climate of the housing market.

Excerpt taken from an article by Steven Thomas.