Boiling Over

Fierce demand, throngs of buyer tours, bidding wars, rapid appreciation, and limited available homes to purchase are all due to historically low rates.

In heading to Baskin Robbins on the 31st of any month with 31 days, there are lines out the door. Normally a scoop of ice cream is $2.79, but not on the 31st. On those seven days of the year, a scoop drops to $1.70, a 40% savings. For a large family with a bunch of kids, this is the day to make the pilgrimage to Baskin Robbins. And that is precisely what families do. As a result, there are long lines, and a long wait, to get that discounted scoop of deliciousness.

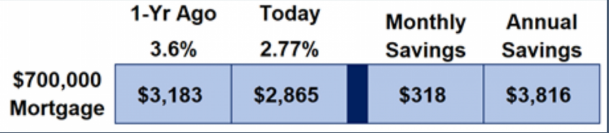

When a commodity drops to a price that is too good to pass up, everybody flocks to purchase. That is precisely what is occurring in housing. It is not that home values have plunged by 40%; instead, it is historically low mortgage rates that are the catalyst to surging demand. As a result, buyers are coming out in droves to purchase. It is too good to pass up. For a $700,000 mortgage at last year’s 3.6% fixed rate, the payment would have been $3,183 per month. With today’s 2.77% rate, the payment drops to $2,865, a $318 per month savings, essentially a 10% discount. Comparing today to November 2018 when rates nearly hit 5%, the savings jumps to $893 per month, a 24% savings. It is not a one-time savings either. This savings is every single month for 30-years.

Excerpt taken from an article by Steven Thomas.