Mortgage Rates this week are under some pressure as the Federal Reserve reiterated it’s 0% interest rate policy through 2023! As a result, I’ve had many clients calling to ask whether mortgage rates are 0% since the Fed just kept rates at 0%. People hear a headline on the news or a radio soundbite mentioning the words “Fed, rate, zero,” and then assume the Fed just made some change that dropped rates to zero percent. After all why would there be so many news headlines about it if the Fed merely kept its policy rate unchanged?

It’s a fair question in that sense, but understand that the Fed’s rate decision will always make the news, even if the rate is the same as it has been since March (and it is). As such, if mortgage rates weren’t 0% for the past 6 months, they wouldn’t be zero now. And in fact, they’ll never be zero simply because the Fed Funds Rate is zero. These are two entirely different rates that apply to vastly different amounts of time and types of transactions.

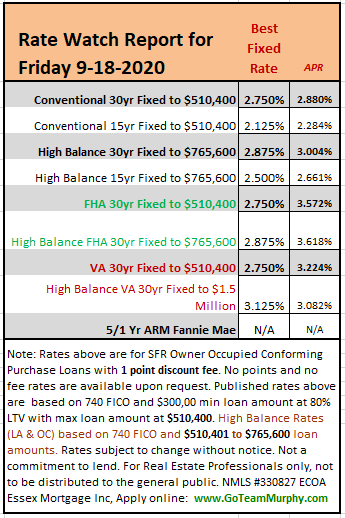

The Fed Funds Rates governs overnight transactions between large financial institutions. Mortgage rates govern–well… mortgages! The Fed actually buys mortgage-backed debt at the same price as the rest of the bond market. Those prices are currently yielding rates around 3% in terms of top tier 30yr fixed loans. In that sense, the Fed is indeed setting mortgage rates, just at the same levels as everyone else and without much change from the past few days.

By far and away the biggest factor for recent rate movement has been the recently announced adverse market fee. It caused rates to spike significantly in early August when it was first announced. Rates then recovered when it was delayed several weeks ago. And now that we’ve hit the time frame where lenders need to re-implement the fee, rates have spiked quickly, but only for those lenders. As such, rates are significantly worse for some lenders compared to last Friday while others are slightly better. Ultimately though, any lender making a loan for a conventional 30yr fixed refinance will have to account for this fee, and most of them will be doing that before the end of this month (a majority already have as of this week). Essex will begin implement this on 9-26-2020!

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com