Mortgage Rates are moving higher, but only a modest pace compared to Wednesday & Thursday Over the past 3 days, the average rate quote for a top tier conventional 30yr fixed loan has risen by an eighth of a percent (.125%), much higher moves for high balance loans. The last 3 days account for most of the move higher, making it one of only a handful of periods/days with as much upward movement in the past few years!

Is an eighth of a point a big deal? Only you can answer that. It comes out to about $7/month for every $100k in loan amount. For some, it’s not a big deal, but for others it can make or break a transaction. Either way, everyone can agree it would be a bigger deal if we were to see additional examples of similar spikes in the near future.

So will we?

That’s definitely possible, as this selling continues in bonds (that is why yields are rising, remember it’s an inverse relationship. Bonds have yet to find a bottom and I am not sure we find it soon. Why? Because when I look at the hedging contracts out there I can see just how bearish the sentiment is. Four times as many PUTS have been purchased than calls. Traders buy PUTS when they are betting the market will fall. We can also see that the Big Money players are still selling.

Because of this, we are recommending our clients LOCK as soon as escrow opens.

On a positive note, these rates are still AMAZINGLY low!

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com

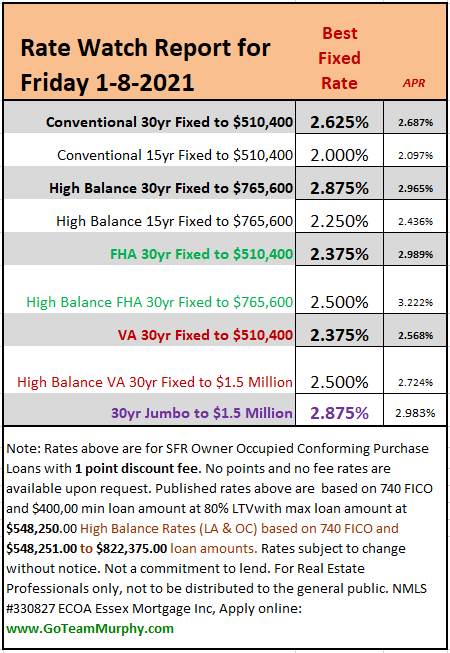

Rate Watch Report