A Buying Opportunity

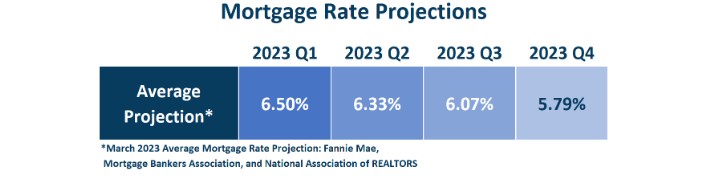

Prospective home buyers are perplexed at today’s competition to purchase, which will only amplify when rates drop in the future. Many experts forecast mortgage rates to drop into the 5s by year’s end.

This year’s March Madness ended with an unexpected NCAA Championship matchup between San Diego State University (ranked 18th before March Madness) and the University of Connecticut (ranked 10th). Three teams made their first Final Four appearance. Not a single team was ranked #1, #2, or #3. The critical takeaway is that sometimes it is best to expect the unexpected. It does not always play out the way everyone thinks.

This year’s housing market is also playing out much differently than expected. Nobody anticipated buyers bumping into each other with very few available homes to purchase, throngs of buyers cramming into weekend open houses, and bidding wars that result in multiple offers and sales prices above their asking prices. With today’s high mortgage rate environment, values were expected to continue to fall throughout 2023. That is precisely what occurred in the second half of 2022 when mortgage rates continued to soar higher, buyer demand plunged, and the inventory climbed and peaked at its highest level in two years. But that all changed as the inventory plunged to crisis levels.

The high mortgage rate environment affected both supply and demand. Naturally, everyone anticipated that high rates would enormously impact affordability and weaken buyer demand. Yet, very few anticipated that high rates would inhibit so many homeowners from listing their homes for sale. During the first three months of 2023 in Orange County, 45% fewer homes were placed on the market, or 4,538 missing sellers. Homeowners are staying put and “hunkering down” because of their locked-in, low, monthly fixed mortgage payment. As a result, the inventory has dwindled, and the housing market has heated up substantially since January. The inventory has dropped from 2,530 in January to 2,142 today, a 15% drop. The 3-year average before COVID (2017 to 2019) was an increase of 15%, from 4,665 to 5,533.

At this point, the lack of home sellers impacts the housing market more than diminished demand, which explains the return of multiple offers and sales prices above the asking prices. Where will the market go from here? It all depends upon mortgage rates. Experts have had a tough time anticipating the direction of rates as it is closely tied to inflation. The trend reveals inflation is slowing falling, but it could take more than a year to reach the Federal Reserve’s 2% core inflation target. To combat inflation, the Federal Reserve increased rates at its fastest pace since 1981. It appeared as if they were poised to continue to increase the Fed Funds rate even higher than anticipated this year until the collapse of Silicon Valley Bank, Signature Bank, and Silver Bank within a week in March. Before the bank failures, mortgage rates were just above 7%. Since then, rates have fallen and bounced between a high of 6.75% on March 21st (according to Mortgage News Daily) and a low of 6.38% on March 24th. They are at 6.44% today. The bank closures and the exposed pressures on banking have changed the outlook for mortgage rates, and many experts are now expecting a U.S. recession between the third and fourth quarters of 2023.

Excerpt taken from an article by Steven Thomas.