Mortgage Rate Move HIGHER Towards Recent Highs after Upbeat Economic Data!

Mortgage Rates moved higher this week, inching towards the lower recent levels in response to economic data that show the economy and inflation ticking upward.

That’s important because the Fed’s treatment of rates and rate momentum itself is repeatedly characterized as “data dependent.” In early December, Fed Chairman Powell announced a pivot in policy and said Fed would cut rates 3-4 times staring in early 2024.

However, this first week of 2024, we are getting a different narrative from the Fed. Now they hinted this week they may need to RAISE rates another ¼ point in the first quarter.

It appears the Fed and markets are smoking crack and cannot decide what’s next…

Case in point, today Non-Farm Payrolls for Dec (think new jobs posted) increase to 216,000 with Fed looking for 170,000. In addition, the unemployment rate came in lower at 3.7%. In a counter move, the ISM Mfg PMI print was weaker at 50.6, suggesting a slowdown in manufacturing.

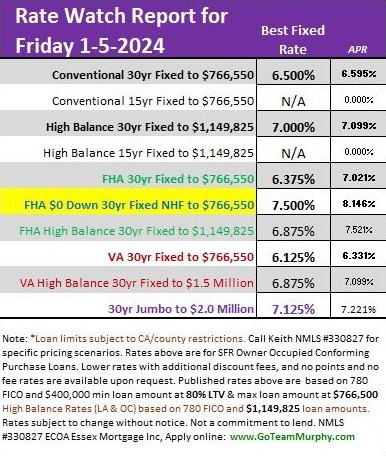

Bottom Line: Mortgage Rates are still LOWER than most of2023 it would be wisdom to LOCK as it appears market wants to go higher (at least for now).

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com