No Flood of Foreclosures

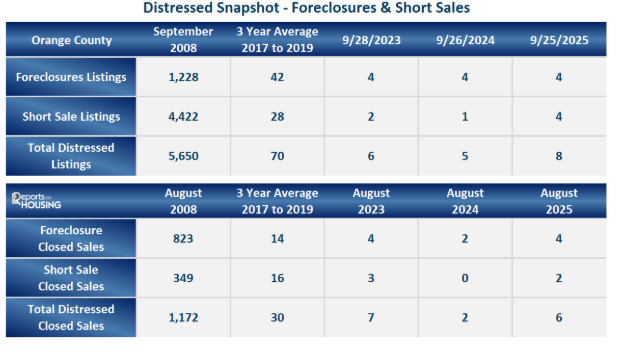

With the jobs market slowing and the collapse in home affordability due to the high-rate environment, many wrongly assume that there will be a sharp increase in foreclosure and short-sale activity that rivals the Great Recession.

Homeowners across the U.S. are healthier than ever before, which will prevent a sharp rise in distressed sales.

People often jump to incorrect conclusions. When an airplane experiences turbulence, many passengers assume that the plane is going to crash. Many flights experience turbulence, but it does not necessarily mean disaster is imminent. In watching a favorite sports team fall decisively behind at the beginning of a game, fans often give up hope, feeling certain that their team will lose. Falling behind early is a challenge, but it does not determine the outcome. There are countless examples of teams clawing their way back to victory.

Similarly, many have drawn an incorrect conclusion regarding housing. The housing market has been critically unaffordable for over three years, resulting in a waterfall dive in the number of closed sales. As home prices skyrocketed during the pandemic, followed by mortgage rates more than doubling, the pool of potential buyers evaporated. As a result, many people have mistakenly assumed that the housing market would resemble the Great Recession, with a flood of foreclosures. Unfortunately, the general public often jumps to conclusions without considering all the facts and trends.

Excerpt taken from an article by Steven Thomas.