Flips experience frenzy as market tightens

There are few more interesting real estate investments than home flipping — seeing an older or run-down piece of property find a fairy godmother to make it beautiful again and then being sold in several months’ time. According to a report in Realtor.com, home flipping activity is increasing across the country, as more investors look to capitalize on the run-up in home prices.

On par with the highest home-flipping rate since the first quarter of 2012, nearly 50,000 single-family homes and condos were flipped in the first quarter of this year, comprising 6.9 percent of all home sales, according to ATTOM Data Solutions’ Q1 2018 U.S. Home Flipping Report.

Even profits were up. with flips in the first quarter of this year selling at an average gross profit of $69,500, up from $66,287 a year ago, the highest average gross profit for flips since ATTOM began tracking such data in 2000. A flip is defined as a property that has been sold more than once in a 12-month period.

The data company’s senior VP Daren Blomquist is cited in the report saying, “The 2018 housing market is a double-edged sword for home flippers. Rapidly rising home prices boosted by low inventory of homes for sale or for rent are padding profits at the back end when flippers sell. But those same market realities are eroding flipping returns at the front end by forcing flippers to pay more to acquire homes to flip.”

Memphis, TN won the prize for the highest flip rate of the 136 metros with 15.1 percent, followed by Albany, Ore. (11.7 percent); East Stroudsburg, Pa. (11.4 percent); York, Pa. (10.4 percent); and Merced, Calif. (10.3 percent).

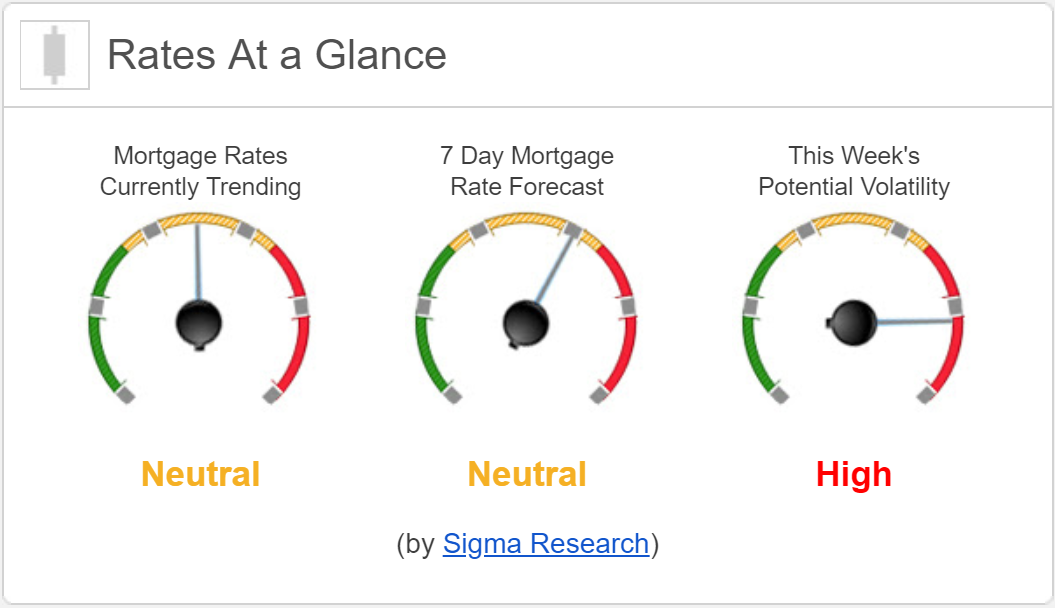

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -25bps. This was enough to move rates higher last week. Mortgage rate volatility was relatively low last week.