It is time to get off the fence before values rise and while mortgage rates are so low.

Cost to Waiting: Housing is poised to get hotter next year, setting the stage for appreciation.

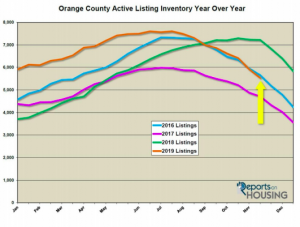

Disneyland is known as “The Happiest Place on Earth.” Yet, sometimes the amusement park can be so crowded. The lines for Space Mountain are often the longest. So many people take a look at the length of the line and turn around claiming that they will try to wait for the perfect time. They rationalize that the evening will be much better after a ton of families with little kids leave for the day. To their dismay, after returning to check the line in the evening, the line has not changed. In fact, it is a little bit longer. Was it because of the warm evening? Did all these people in line try to time the line too? Many buyers are trying to time the housing market. They too are trying to wait for the “perfect time.” They hear that the real estate market is doomed, that housing is on the verge of a bubble, or how the next downturn will be worse than the Great Recession. These buyers are sitting on the fence and are waiting for it to be there turn. It is inevitable, right? Unfortunately, all the noise, is just that… noise. The facts and data simply paint a completely different picture. It has been frustrating being a buyer. From 2012 through the first half of 2018, everybody was acutely aware that there was a supply problem. That changed last year when the active inventory ballooned from August through Thanksgiving. There was finally a lot more supply, but it was only due to a demand problem. Demand dropped as mortgage rates climbed all the way to 5% in November. Everybody thought it was the beginning to the end of housing’s 6-year run-up. But that was then, and this is now. Mortgage rates today are at 3.75%. This year has been all about recovering from the sting of high interest rates and low demand. Rates continuously dropped and bottomed at 3.5% in September. They had plunged by 1.5% in such a short period of time. It was unprecedented. As a result of the current low interest rate environment, housing has transitioned from a slight Buyer’s Market at the beginning of the year, to a Balanced Market in February, to a slight Seller’s Market ever since. In fact, the market has been picking up steam and the Expected Market Time (time from originally listing to opening escrow) just dropped to its lowest level of the year. Regardless of the time of year, housing is heating up with the active inventory dropping like a rock and demand remaining relatively flat. Since the end of July, the active listing inventory has shed 2,067 homes, a 27% drop. That’s the largest decline since 2012. At the same time, demand (last 30-days of pending sales) has only dropped by 7%. It has not looked that good since 2011. Consequently, the Expected Market Time dropped from 91 days at the end of July to 71 days today, a slight Seller’s Market (from 60 to 90 days), which is when there is not a lot of appreciation and sellers get to call more of the shots during negotiations. Housing is knocking on the door of a HOT Seller’s Market (less than 60 days) where there are multiple offers and home values appreciate. While it may be frustrating for buyers to hear that the supply problem is back and the market is getting hotter, these frustrations can be overcome by focusing on the payment and diving into the market now before it heats up further. A $700,000 mortgage has a monthly payment of $3,242 today. For perspective, that same payment last year was $3,758 with a 5% rate, an eye-opening $516 extra every single month. But, let’s take it a step further. With a supply problem in 2020 coupled with low mortgage rates, home values are forecasted to appreciate between 2 to 4%. Even if rates remain the same, at 4% appreciation, that $700,000 mortgage would become $728,000 and the monthly payment would be $3,371, that’s an additional $129 per month or $1,548 annually. What if rates grew to 4.25%? A mortgage rate of 4.25% would still be a great rate and would not rock the housing boat much at all. With 4% appreciation and a rate that is a half percent higher, the monthly mortgage payment would be $3,581 per month. That is an additional $339 per month or $4,068 annually.