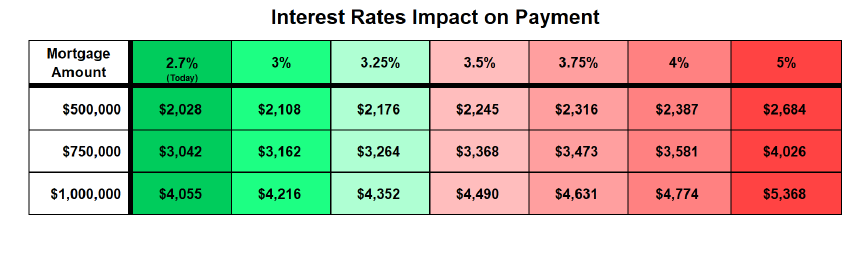

Interest Rates | Lock It In!

The current 30-year mortgage rate is at 2.7%, a 14th record low since March

Black Friday, Cyber Monday, Amazon Prime Day are all days that countless Americans look forward to cashing in on the very best deals of the year. From flatscreen televisions to blenders to puffy winter jackets, prices are slashed, and eager shoppers line up to take advantage of the mind-blowing discounts. Many stores carry a limited quantity, so if “you snooze, you lose.” For 2020, those days are in the past and it will not be until the end of 2021 when they return.

Today’s mortgage rates are at a record low and they offer the very best deal of the year. Soon, that deal will vanish, and rates will rise, which will impact monthly payments and affordability. Many think the Federal Reserve is in charge of setting mortgage rates, but that is not true. Instead, they set the short term fed funds rate, currently at zero. This rate affects automobile loans, credit card rates, and small business loans, also known as “short term debt.” Long term debt, or 30-year fixed mortgages, are tied closer to long term bonds. Watching any movement in U.S. 10 Year Treasury bonds will indicate where mortgage rates are headed. Prior to this year, the 10-Year has never been below 1% (it is at 0.896% today). Similarly, prior to this year, mortgage rates have never been below 3% (they are at 2.7% today).

Excerpt taken from an article by Steven Thomas.