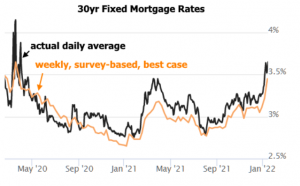

Mortgage Rates have move higher since last Friday. In the past 2 weeks, press coverage of the Federal Reserve’s policy outlook has ramped up significantly. In addition to tapering, the Fed is now expected to start hiking rates in March and to hike more than previously expected in 2022. If you think that gives you time to get a mortgage before rates go up, think again.

So why did rates spike on Friday?

This is actually a bit of a trick question. If you are reading my weekly market updates, you know mortgage rates have been rising in general since late 2020. The current rate spike really began last week. The first 4 days of the week were mostly a lull in the bigger picture. They had a chance to be the start of a bigger reversal, but ultimately revealed themselves to be a breath-catching exercise before more pain. In other words, it was a trap–at least for anyone hoping that rates would do something better than catch their breath.

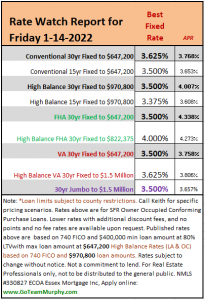

The response is varied among mortgage lenders in terms of scope and timing, but on average, 30yr fixed rates are nearly 3/8ths of a point higher in the first 2 weeks of 2022. Even the notoriously stale but widely-cited Freddie Mac weekly rate survey mostly caught up to reality with their biggest jump since the start of the pandemic

Bottom Line: unfortunately the rise of interest appears to be far from over, but we can hold hope the Fed will change its policy direction on January 26th in light of market volatility, geopolitical risks, and the omicron surge. I am recommending clients lock as soon as escrow opens.