Lack of inventory continues to push prices higher

It’s a great time to be a seller, but not such a thrill being a rookie buyer. Soaring home prices and the shortage of properties on the market are taking a toll on beleaguered first timers.

The share of first-time homeowners fell to just 29% of all existing home buyers in January, according to the most recent National Association of Realtors report, down from 32% in December and 33% in January 2017.

In the report, economist Joseph Kirchner expresses concerns this could further depress homeownership rates down the line, citing fewer affordable homes for those embarking on their version of the American Dream.

Nationally, the lack of inventory also drove down the number of existing (previously lived in) homes sold, while monthly sales dropped 3.2% and annual sales decreased 4.8%.

“There’s plenty of demand, but people just cannot find a home on the market that meets their needs and they can afford,” Kirchner says in the report, predicting that the shortage will continue.

Across the country, there were 15.5% fewer existing homes in January selling for $250,000 or less compared to a year ago, while there were 25% more homes selling for $500,000 or more.

Sales of coveted single-family homes hit 4.76 million in January, falling 3.8% from December and 4.8% from the same month a year earlier. Lower priced condos and co-ops fared a bit better than single-family homes, with the number of monthly sales rising 1.6% in January to approximately 620,000. But that’s down 4.6% from January of 2017.

January’s median existing home price was $240,500, a 2.4% drop from December but representing a 5.8% jump from January of the previous year. However, the cost was still substantially less than the median price of a newly constructed dwelling. New homes median pricing was at $335,400 in December, according to the most recent joint report by the U.S. Census Bureau and U.S. Department of Housing and Urban Development. That’s nearly 39.5% more than an existing home.

Southern states had the most existing home sales in January at about 2.26 million, while the Midwest had the second most home sales at 1.25 million. There were 1.14 million existing homes sold in the West, a 5% drop from the previous month and a 9.5% fall from the previous year. The Northeast had the fewest existing home sales, at just 730,000. That was also down, both by 1.4% month-over-month and 7.6% year-over-year.

Meanwhile, prices of existing homes were up in every region. They were the most expensive in the West, at a median $362,600 in January, an 8.8% jump over January 2017.

NAR Chief Economist Lawrence Yun is quoted as saying, ”It’s very clear that too many markets right now are becoming less affordable and desperately need more new listings to calm the speedy price growth.”

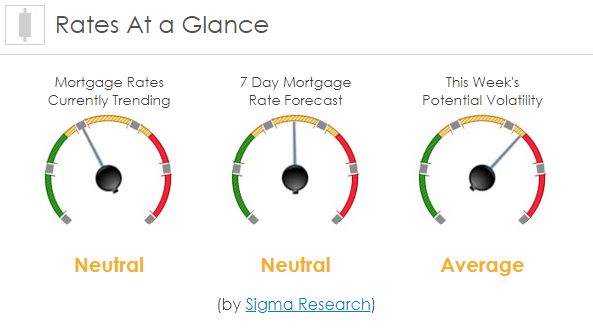

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +13bps. This probably wasn’t enough to improve mortgage rates or fees. Mortgage rates continue to move sideways with relatively low volatility.