Sellers Look to Turn Hefty Profits in High Demand Areas

In-demand areas of the U.S. are seeing a sizable inventory jump, with sellers looking to turn profits, according to a realtor.com® report released Wednesday.

California’s San Jose-Sunnyvale-Santa Clara metro area, where the median listing price reached $1.205 million in July, is seeing homes taking on the average of 26 days to sell, while the number of listings rose 44% year-over-year, representing the largest increase in the country, according to the report.

The Pacific Northwest is seeing Seattle and its surrounding suburbs offering 29% more homes on the market in July, compared to the same period last year, with the median home price now at $569,000, taking an average of 30 days to sell.

Looking big picture, across the U.S., the median listing price remained at a record high of $299,000 in July — flat from June, but an increase of 9% on an annual basis. Meanwhile, U.S. homes sold in an average of 59 days in July, 5 days faster than last year.

Overall housing inventory fell 4% year-over-year in July, but listings above $350,000 were up 5.7%.

“July inventory growth is in high-priced, competitive markets, and often at the pricier end of these markets,” Danielle Hale, chief economist for realtor.com, said in the report. “It’s not just California markets that have seen an increase in inventory, markets on both coasts and in the South reported inventory increases in July,” she said in the report. “Although signs of an inventory turnaround are encouraging, whether they mean good news for buyers remains to be seen. These areas are seeing more new listings and some construction growth, but high prices and fast-selling homes are causing some buyer hesitation which is reflected in fewer home sales.”

The 45 largest metros saw prices significantly higher in markets where inventory is rising, and where the median home price averaged $494,000 in July, compared to an average price of $302,000 in markets where inventory is falling, according to the report.

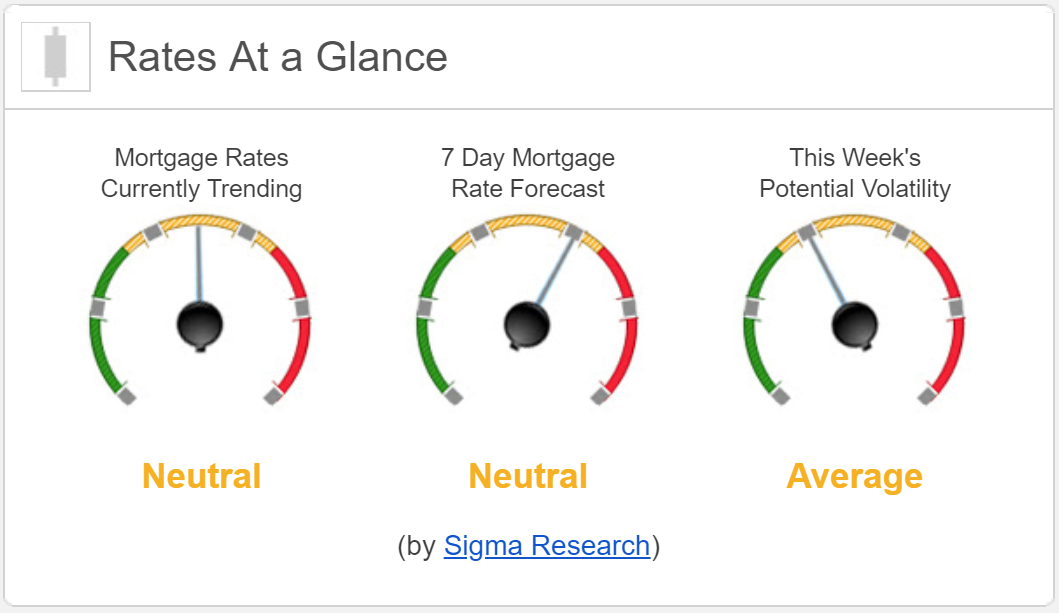

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by +1bps. This was not enough to move rates. There was very little mortgage rate volatility last week.