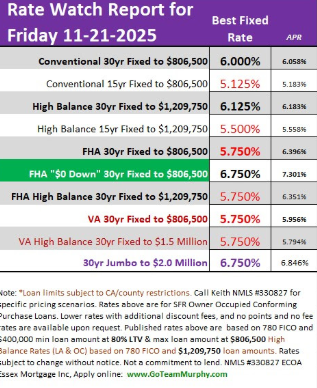

Mortgage Rates Securely Holding Ground

Mortgage Rates have been choppy this week, driven by the Government re opening and the release of this week’s Job Report. *take a look at the Rate Grid below and see all the RATES in RED!

Bond Market Update This Morning

- Treasury yields are easing slightly: The 10-year note yield is down about 3 basis points to 4.072%, and the 30-year yield is slipping to 4.723%.

- Why this matters: Mortgage rates are closely tied to bond yields. When yields fall, mortgage rates often follow.

- Market drivers today:

- Investors are digesting weaker jobless claims data earlier this week, which suggests a softer labor market.

- Reduced expectations for a Fed rate cut in December are keeping volatility elevated.

- Stock markets are mixed, with futures showing only slight moves after a volatile week.

Bottom Line: Bond yields dipping this morning could help keep mortgage rates from climbing further as we head into the weekend. If economic data continues to show softness, rates may even drift lower in the near term.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com