Mortgage Rates in general have been in a correction mode since last Friday. They say “a picture paints a thousand words”, so let’s begin this market recap with an image of the 10yr Treasury Yield (*if you watch the 10yr treasury on Yahoo Finance or CNBC every day, you WILL know the directing of mortgage rates).

Below is the last 5 trading day of the US 10yr Savings Bond Yield. As you can see, rates are heading in 1 direction which is UP! (*Reminder, when traders sell bonds, the bond prices fall, and yields rise due to the inverse algebraic relationship).

Let’s take a look at the graph below to see what is driving this rapid change towards higher rates.

After hitting the lowest levels in more than 4 months last week, they popped quickly back to the highest levels in a month! So, what happened? During a light week for economic data release, investors to their cue from the Fed, and Chairman Powell did not paint a rosy picture by making it loud and clear that MORE WORK needs to be done to bring down inflation. In the speech this Tuesday EMPASIZED that due to strength in the labor markets, bringing down inflation will be TOUGHER than originally thought, and that the process will take a SIGNIFICANT period of time with more rate increases and holding higher for longer than originally anticipated.

Bottom Line: this is an unfortunate U-turn in the lower rates we have seen over the last couple of weeks. Application spiked and activity was really picking up, but I am afraid we have turned a corner and praying it’s short lived. In the meantime, have all your pre-approved clients meet with their Loan Officer to see HOW this impacts their buying power.

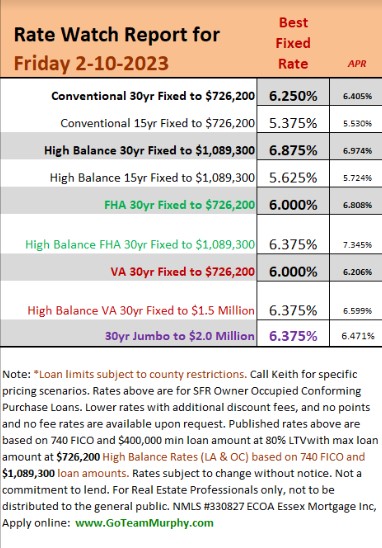

Here are lockable rates at of 10:00am PST.

SOURCE & AUTHOR |

Keith Murphy Branch Manager – Essex Mortgage NMLS #330827

Direct: 714-309-1140

Apply: www.GoTeamMurphy.com