Mortgage Rates are ticking slightly lower this morning, October 24, 2025, compared to last Friday—and it’s all about inflation. The CPI report came in softer than expected, calming bond markets and nudging rates down.

CPI Report: What Came Out vs. What Was Expected

CPI Report: What Came Out vs. What Was Expected

The Consumer Price Index (CPI)—a key measure of inflation—was released this morning after a delay due to the government shutdown. It showed:

Annual CPI: +3.0% (vs. 3.1% expected)

Monthly CPI: +0.35% (vs. 0.4% expected)

Core CPI (excluding food and energy): +3.0% (vs. 3.1% expected)

This “cooler-than-expected” inflation print reassured investors that inflation isn’t accelerating, which reduces pressure on the Federal Reserve to keep rates high.

Why the Bond Market Reacted—and Why It Matters for Mortgage Rates

Why the Bond Market Reacted—and Why It Matters for Mortgage Rates

Bond traders have been flying blind during the shutdown, with few economic reports to guide them. This CPI release was the first major data point in weeks—and it came in below expectations.

10-Year Treasury Yield: Dropped below 4% this morning

Lower yields = lower mortgage rates, because mortgage pricing is closely tied to long-term Treasury yields.

Investors now believe the Fed is more likely to cut interest rates at its next meeting on October 29, which is helping push mortgage rates down.

Bottom Line:

Bottom Line:

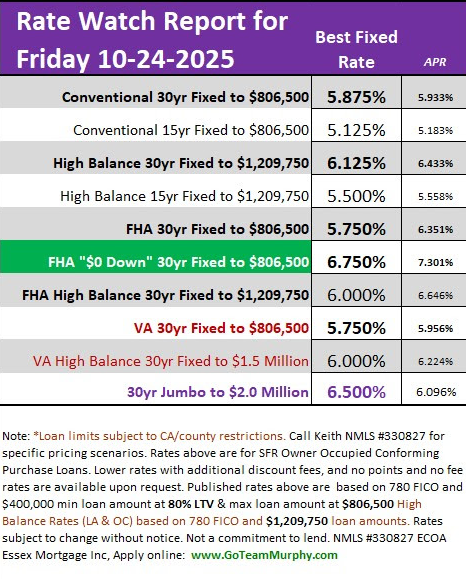

If you’re shopping for a home, today’s dip in rates could mean a lower monthly payment.

If you’re refinancing, this might be a good window to lock in a rate before the next Fed meeting.

SOURCE & AUTHOR | Keith Murphy Branch Manager – Essex Mortgage NMLS #330827 Direct: 714-309-1140 Apply: www.GoTeamMurphy.com